Question: - X - Search... o A * o E C:UsersRalph DownloadsGenerator X Case.mht e Generator X Case A a Amazon.com - Online Sh... Priceline.com TripAdvisor

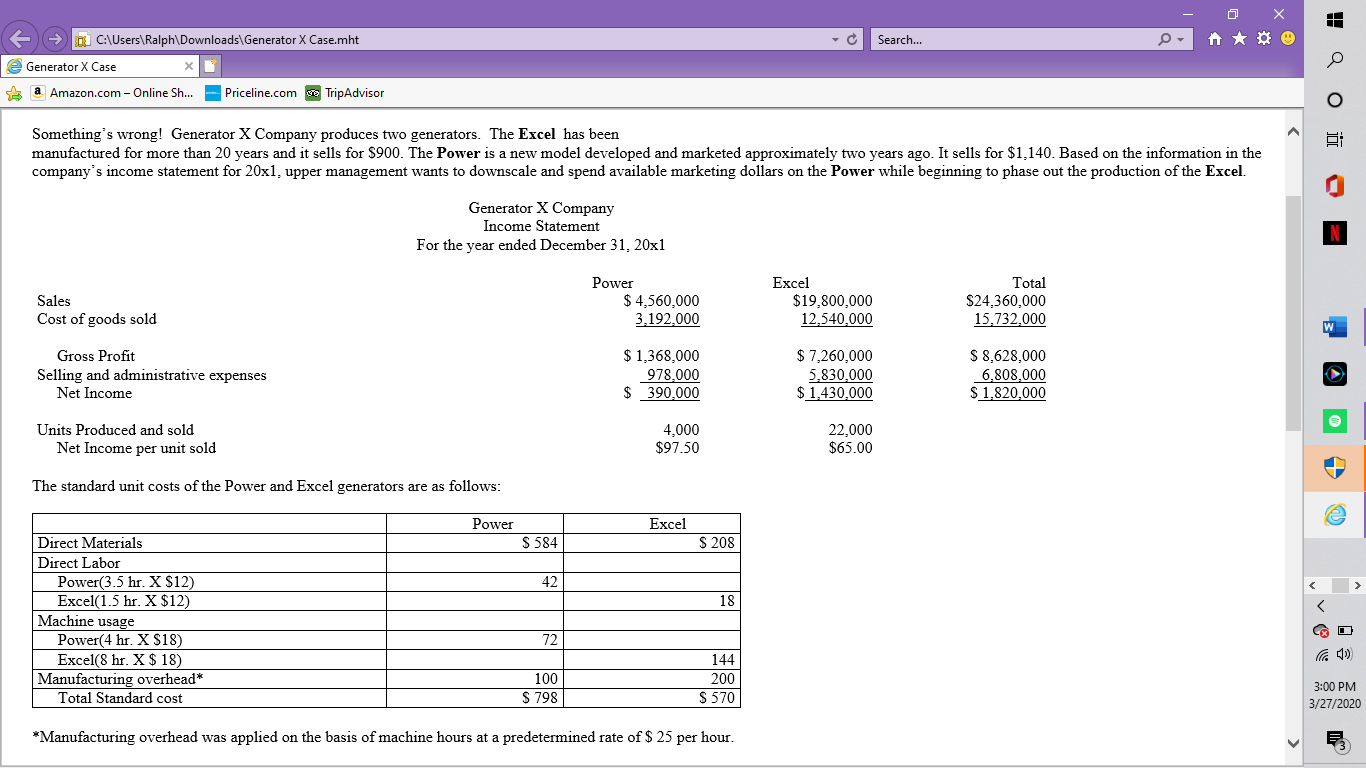

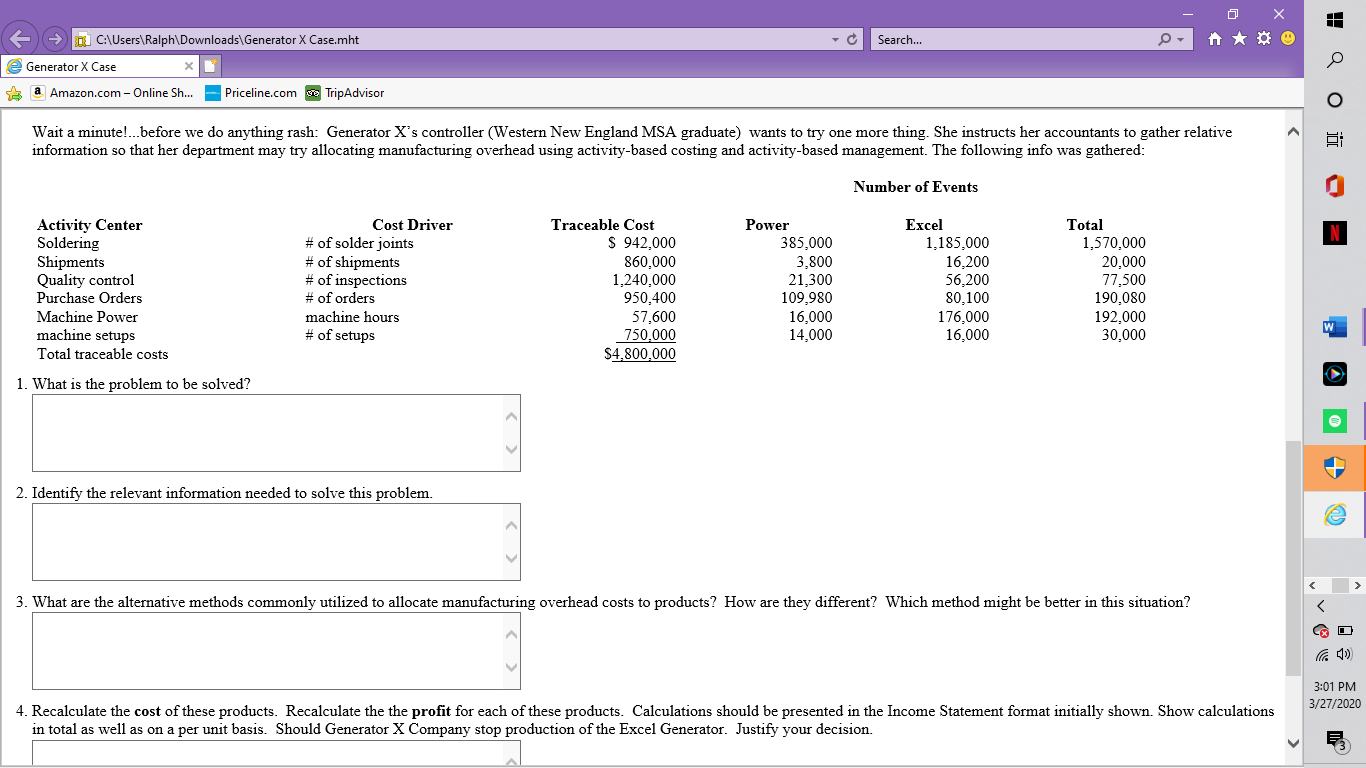

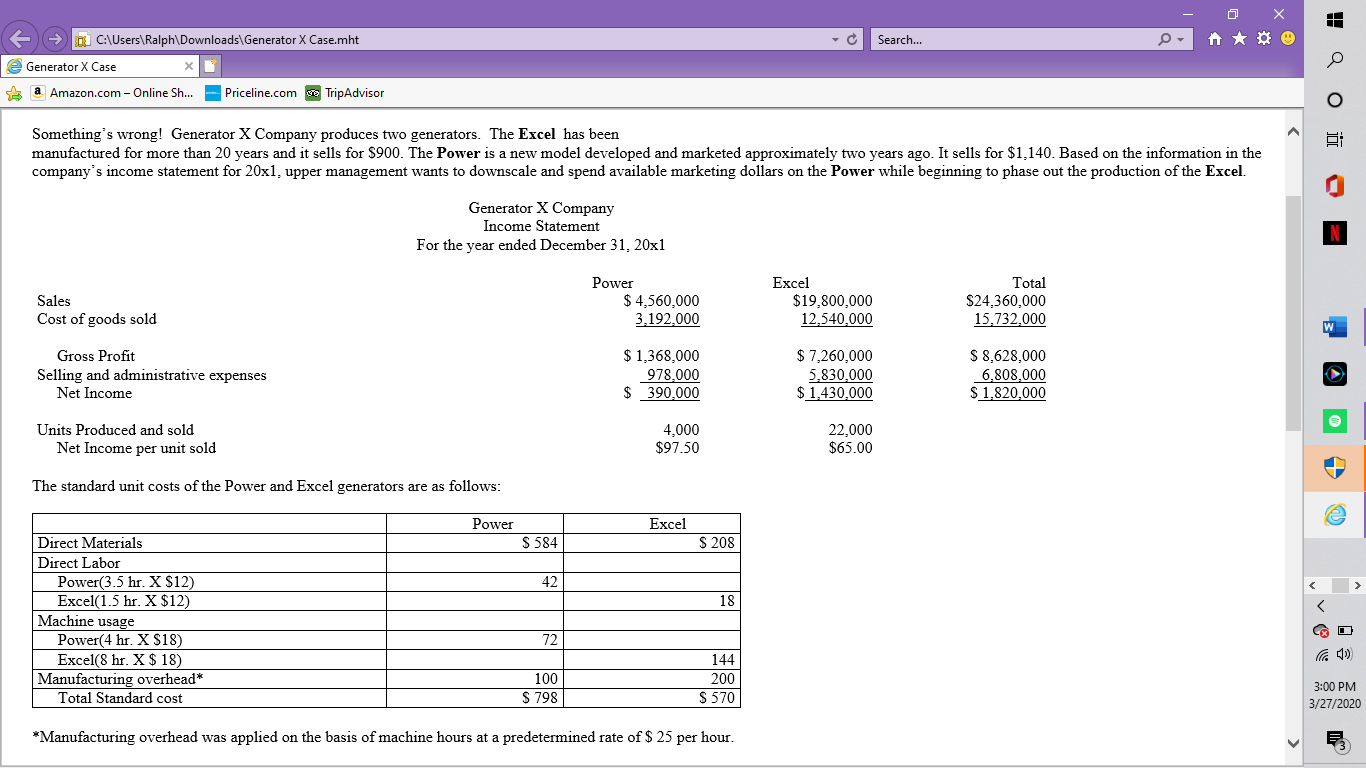

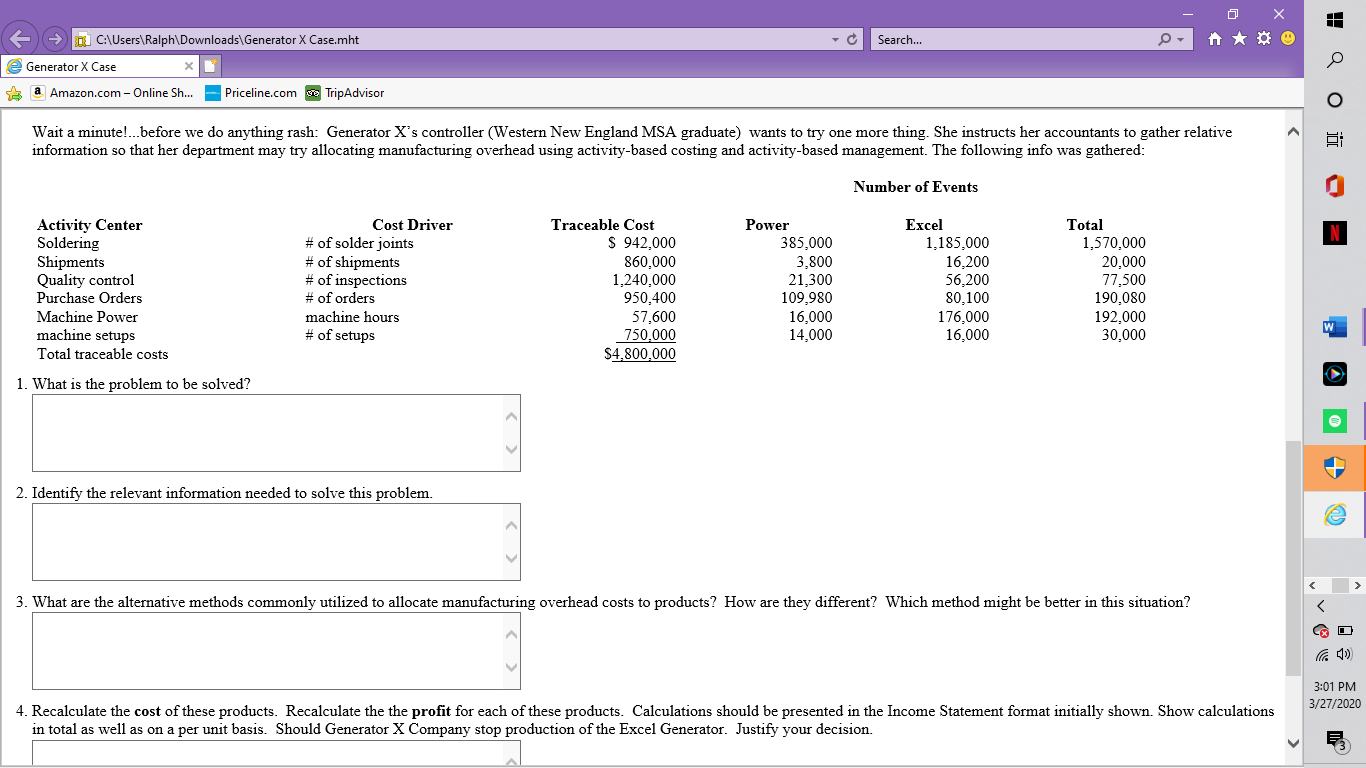

- X - Search... o A * o E C:\Users\Ralph Downloads\Generator X Case.mht e Generator X Case A a Amazon.com - Online Sh... Priceline.com TripAdvisor Something's wrong! Generator X Company produces two generators. The Excel has been manufactured for more than 20 years and it sells for $900. The Power is a new model developed and marketed approximately two years ago. It sells for $1,140. Based on the information in the company's income statement for 20x1, upper management wants to downscale and spend available marketing dollars on the Power while beginning to phase out the production of the Excel. Generator X Company Income Statement For the year ended December 31, 20x1 a o o2 70 OD Sales Cost of goods sold Power $ 4,560,000 3,192,000 Excel $19,800,000 12,540,000 Total $24,360,000 15,732,000 Gross Profit Selling and administrative expenses Net Income $ 1,368,000 978,000 $ 390,000 $ 7,260,000 5.830,000 $ 1,430,000 $ 8.628.000 6,808,000 $ 1.820,000 Units Produced and sold Net Income per unit sold 4,000 $97.50 22,000 $65.00 The standard unit costs of the Power and Excel generators are as follows: Power Excel S 584 S 208 Direct Materials Direct Labor Power(3.5 hr. X $12) Excel(1.5 hr. X $12) Machine usage Power(4 hr. X $18) Excel(8 hr. X $ 18) Manufacturing overhead* | Total Standard cost 72 144 200 100 $ 798 $ 570 3:00 PM 3/27/2020 *Manufacturing overhead was applied on the basis of machine hours at a predetermined rate of $ 25 per hour. X - Search... - - * * E C:\Users\Ralph Downloads\Generator X Case.mht e Generator X Case a Amazon.com - Online Sh... Priceline.com TripAdvisor Wait a minute! before we do anything rash: Generator X's controller (Western New England MSA graduate) wants to try one more thing. She instructs her accountants to gather relative information so that her department may try allocating manufacturing overhead using activity-based costing and activity-based management. The following info was gathered: Number of Events Activity Center Soldering Shipments Quality control Purchase Orders Machine Power machine setups Total traceable costs 1. What is the problem to be solved? Cost Driver # of solder joints # of shipments # of inspections # of orders machine hours # of setups Traceable Cost S 942.000 860,000 1.240,000 950,400 57,600 750,000 $4,800,000 Power 385,000 3,800 21,300 109,980 16,000 14,000 Excel 1,185,000 16,200 56,200 80,100 176,000 16,000 Total 1.570,000 20,000 77,500 190,080 192,000 30,000 a o 70 O 2. Identify the relevant information needed to solve this problem. 3. What are the alternative methods commonly utilized to allocate manufacturing overhead costs to products? How are they different? Which method might be better in this situation? 3:01 PM 3/27/2020 4. Recalculate the cost of these products. Recalculate the the profit for each of these products. Calculations should be presented in the Income Statement format initially shown. Show calculations in total as well as on a per unit basis. Should Generator X Company stop production of the Excel Generator. Justify your decision. - X - Search... o A * o E C:\Users\Ralph Downloads\Generator X Case.mht e Generator X Case A a Amazon.com - Online Sh... Priceline.com TripAdvisor Something's wrong! Generator X Company produces two generators. The Excel has been manufactured for more than 20 years and it sells for $900. The Power is a new model developed and marketed approximately two years ago. It sells for $1,140. Based on the information in the company's income statement for 20x1, upper management wants to downscale and spend available marketing dollars on the Power while beginning to phase out the production of the Excel. Generator X Company Income Statement For the year ended December 31, 20x1 a o o2 70 OD Sales Cost of goods sold Power $ 4,560,000 3,192,000 Excel $19,800,000 12,540,000 Total $24,360,000 15,732,000 Gross Profit Selling and administrative expenses Net Income $ 1,368,000 978,000 $ 390,000 $ 7,260,000 5.830,000 $ 1,430,000 $ 8.628.000 6,808,000 $ 1.820,000 Units Produced and sold Net Income per unit sold 4,000 $97.50 22,000 $65.00 The standard unit costs of the Power and Excel generators are as follows: Power Excel S 584 S 208 Direct Materials Direct Labor Power(3.5 hr. X $12) Excel(1.5 hr. X $12) Machine usage Power(4 hr. X $18) Excel(8 hr. X $ 18) Manufacturing overhead* | Total Standard cost 72 144 200 100 $ 798 $ 570 3:00 PM 3/27/2020 *Manufacturing overhead was applied on the basis of machine hours at a predetermined rate of $ 25 per hour. X - Search... - - * * E C:\Users\Ralph Downloads\Generator X Case.mht e Generator X Case a Amazon.com - Online Sh... Priceline.com TripAdvisor Wait a minute! before we do anything rash: Generator X's controller (Western New England MSA graduate) wants to try one more thing. She instructs her accountants to gather relative information so that her department may try allocating manufacturing overhead using activity-based costing and activity-based management. The following info was gathered: Number of Events Activity Center Soldering Shipments Quality control Purchase Orders Machine Power machine setups Total traceable costs 1. What is the problem to be solved? Cost Driver # of solder joints # of shipments # of inspections # of orders machine hours # of setups Traceable Cost S 942.000 860,000 1.240,000 950,400 57,600 750,000 $4,800,000 Power 385,000 3,800 21,300 109,980 16,000 14,000 Excel 1,185,000 16,200 56,200 80,100 176,000 16,000 Total 1.570,000 20,000 77,500 190,080 192,000 30,000 a o 70 O 2. Identify the relevant information needed to solve this problem. 3. What are the alternative methods commonly utilized to allocate manufacturing overhead costs to products? How are they different? Which method might be better in this situation? 3:01 PM 3/27/2020 4. Recalculate the cost of these products. Recalculate the the profit for each of these products. Calculations should be presented in the Income Statement format initially shown. Show calculations in total as well as on a per unit basis. Should Generator X Company stop production of the Excel Generator. Justify your decision