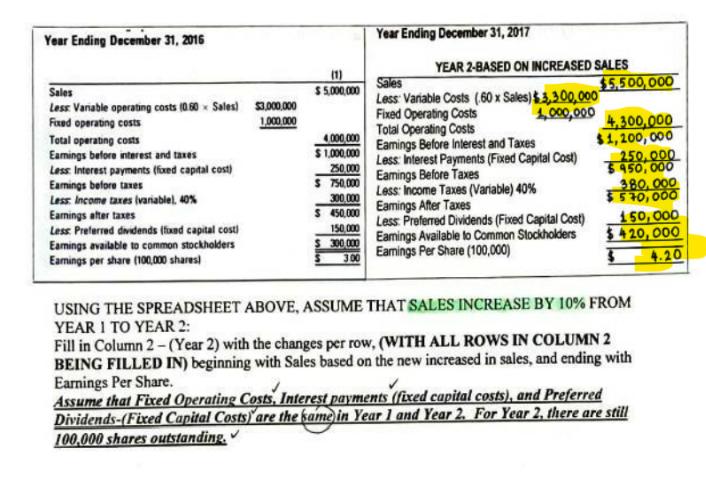

Question: Year Ending December 31, 2016 Sales Less: Variable operating costs (0.60 Sales) $3,000,000 Fixed operating costs 1,000,000 Total operating costs Eamings before interest and

Year Ending December 31, 2016 Sales Less: Variable operating costs (0.60 Sales) $3,000,000 Fixed operating costs 1,000,000 Total operating costs Eamings before interest and taxes Less: Interest payments (fixed capital cost) Earings before taxes Less Income taxes (variable), 40% Earnings after taxes Less: Preferred dividends (fixed capital cost Eamings available to common stockholders Eamings per share (100,000 shares) (1) $5,000,000 4,000,000 $1,000,000 250,000 $ 750,000 300.000 $ 450,000 150,000 300.000 300 Year Ending December 31, 2017 YEAR 2-BASED ON INCREASED SALES Sales Less: Variable Costs (60 x Sales) $3,300,000 Fixed Operating Costs 1,000,000 Total Operating Costs Earings Before Interest and Taxes Less: Interest Payments (Fixed Capital Cost) Eamings Before Taxes Less: Income Taxes (Variable) 40% Eamings After Taxes Less: Preferred Dividends (Fixed Capital Cost) Earnings Available to Common Stockholders Earnings Per Share (100,000) $5,500,000 4,300,000 $1,200,000 250,000 $950,000 380,000 $570,000 150,000 $420,000 4.20 USING THE SPREADSHEET ABOVE, ASSUME THAT SALES INCREASE BY 10% FROM YEAR 1 TO YEAR 2: Fill in Column 2-(Year 2) with the changes per row, (WITH ALL ROWS IN COLUMN 2 BEING FILLED IN) beginning with Sales based on the new increased in sales, and ending with Earnings Per Share. Assume that Fixed Operating Costs, Interest payments (fixed capital costs), and Preferred Dividends-(Fixed Capital Costs) are the same in Year 1 and Year 2. For Year 2, there are still 100,000 shares outstanding.

Step by Step Solution

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Year 2 Increased Sales by 10 Line Item Year 1 Year 2 10 Increase Change Sales 5000000 5500000 500000 ... View full answer

Get step-by-step solutions from verified subject matter experts