Question: You find a zero coupon bond with a par value of $10,000 and 24 years to maturity. The yield to maturity on this bond is

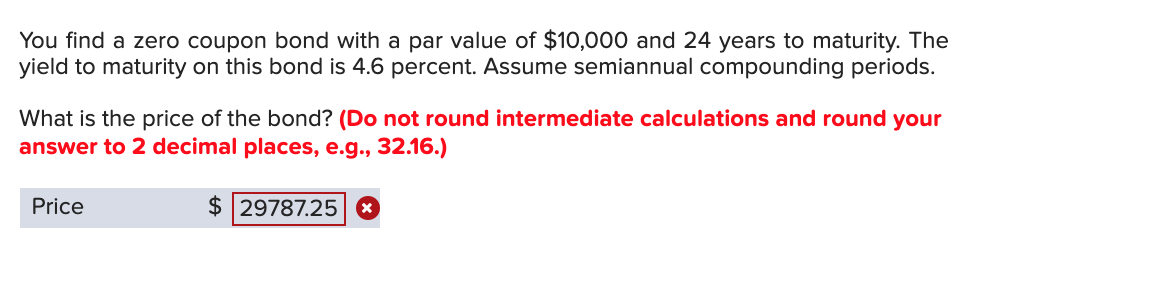

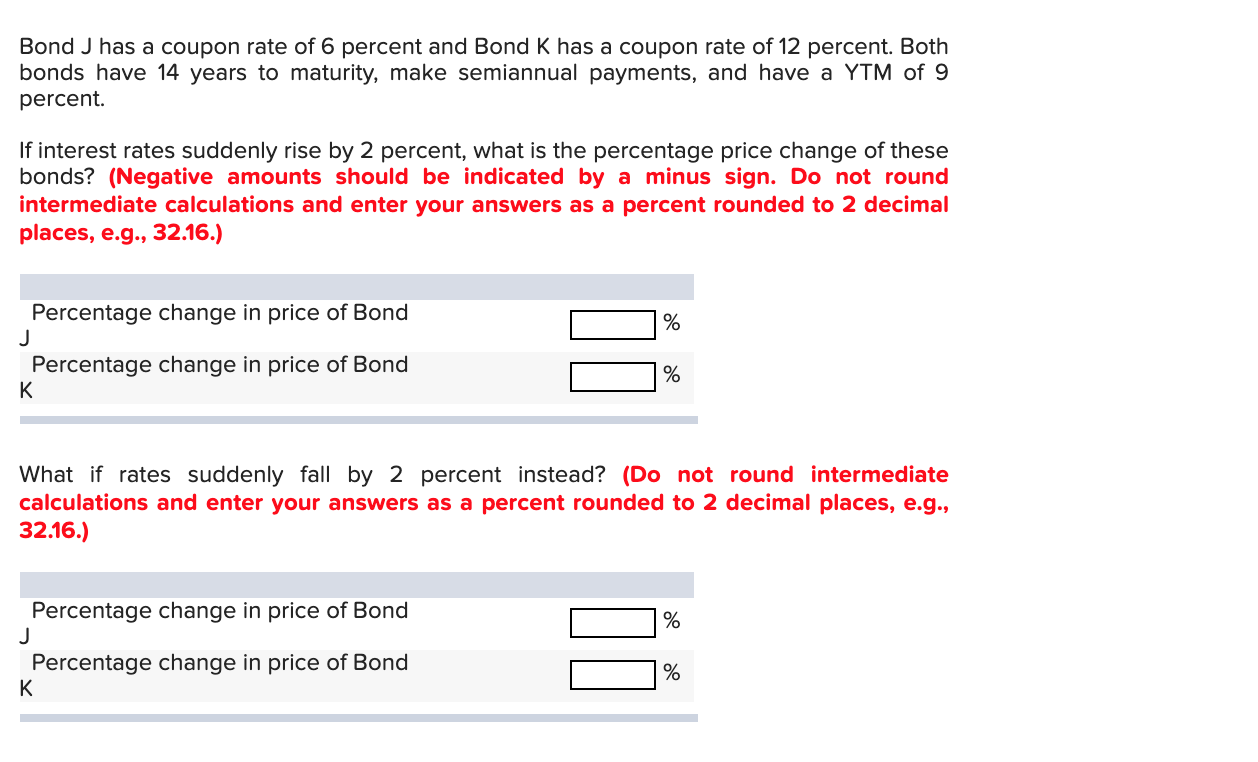

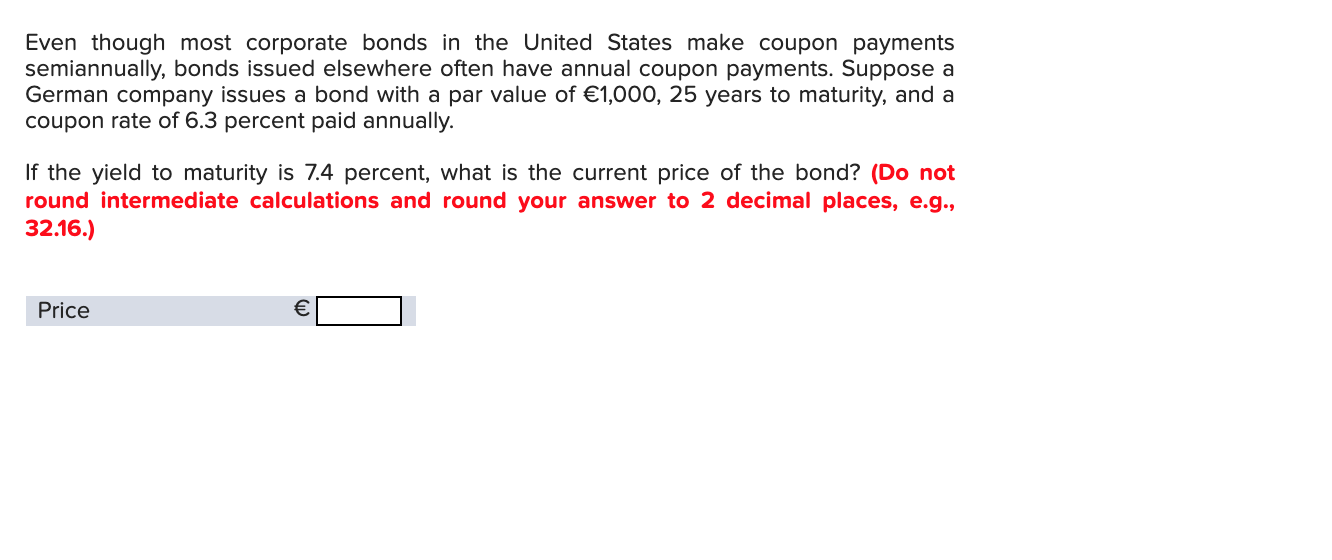

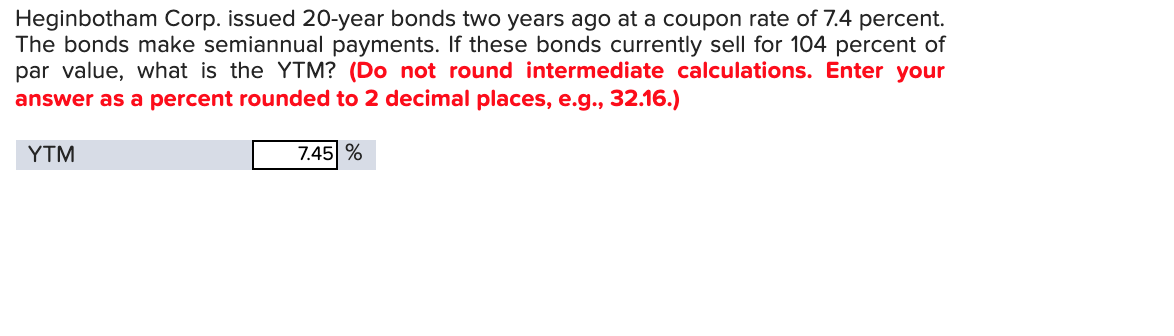

You find a zero coupon bond with a par value of $10,000 and 24 years to maturity. The yield to maturity on this bond is 4.6 percent. Assume semiannual compounding periods. What is the price of the bond? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Price $ 29787.25% Bond J has a coupon rate of 6 percent and Bond K has a coupon rate of 12 percent. Both bonds have 14 years to maturity, make semiannual payments, and have a YTM of 9 percent. If interest rates suddenly rise by 2 percent, what is the percentage price change of these bonds? (Negative amounts should be indicated by a minus sign. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) % Percentage change in price of Bond J Percentage change in price of Bond K % What if rates suddenly fall by 2 percent instead? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) % Percentage change in price of Bond J Percentage change in price of Bond K % Even though most corporate bonds in the United States make coupon payments semiannually, bonds issued elsewhere often have annual coupon payments. Suppose a German company issues a bond with a par value of 1,000, 25 years to maturity, and a coupon rate of 6.3 percent paid annually. If the yield to maturity is 7.4 percent, what is the current price of the bond? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Price Heginbotham Corp. issued 20-year bonds two years ago at a coupon rate of 7.4 percent. The bonds make semiannual payments. If these bonds currently sell for 104 percent of par value, what is the YTM? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) YTM 7.45 %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts