Question: you need to take your own data then solve it Please solve it step wise with little explanation.. You have to take you own figures,

you need to take your own data then solve it

Please solve it step wise with little explanation..

You have to take you own figures, but figures must be taxable..

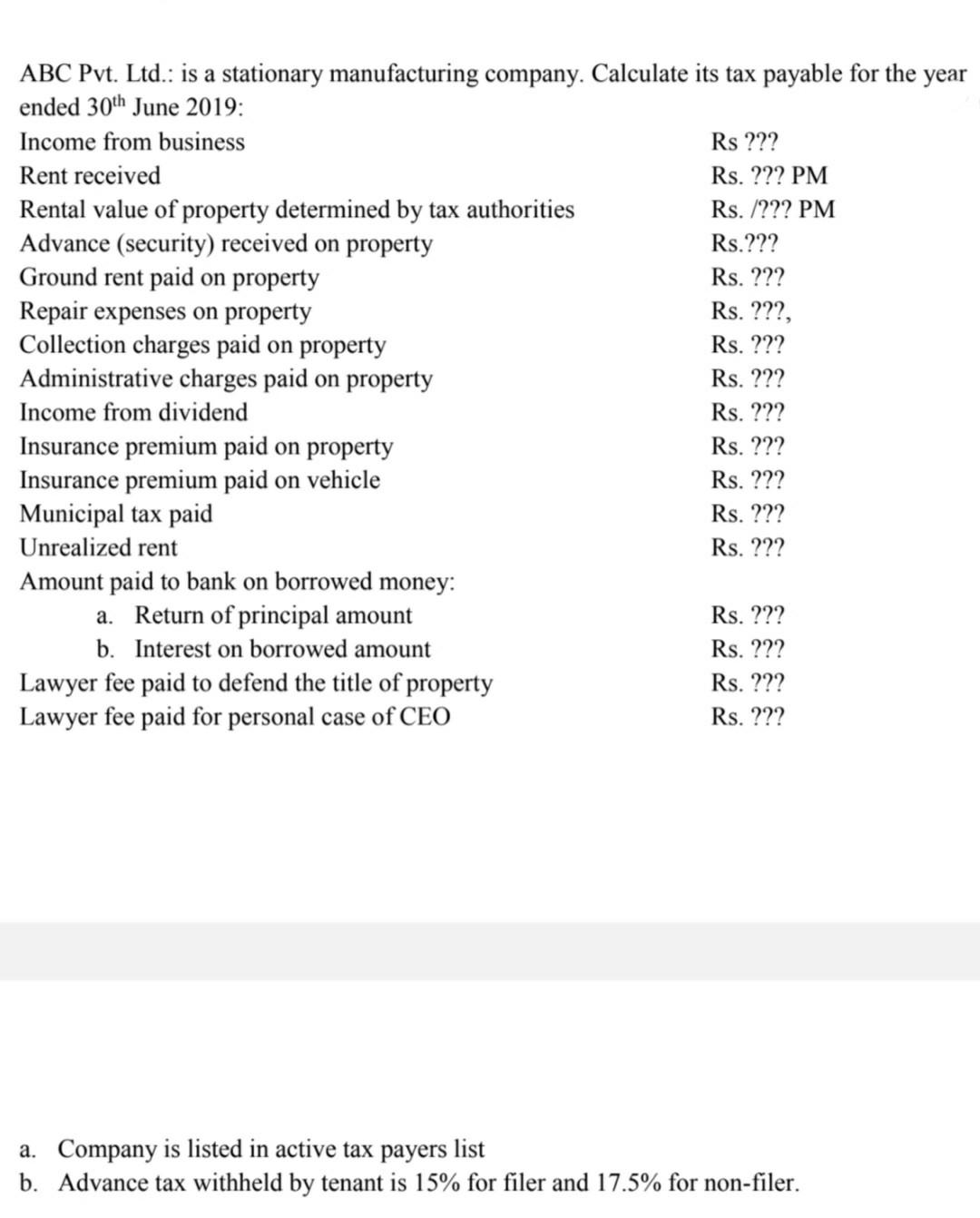

ABC Pvt. Ltd.: is a stationary manufacturing company. Calculate its tax payable for the year ended 30th June 2019: Income from business Rs ??? Rent received Rs. ??? PM Rental value of property determined by tax authorities Rs. /??? PM Advance (security) received on property Rs.??? Ground rent paid on property Rs. ??? Repair expenses on property Rs. ???, Collection charges paid on property Rs. ??? Administrative charges paid on property Rs. ??? Income from dividend Rs. ??? Insurance premium paid on property Rs. ??? Insurance premium paid on vehicle Rs. ??? Municipal tax paid Rs. ??? Unrealized rent Rs. ??? Amount paid to bank on borrowed money: a. Return of principal amount Rs. ??? b. Interest on borrowed amount Rs. ??? Lawyer fee paid to defend the title of property Rs. ??? Lawyer fee paid for personal case of CEO Rs. ??? a. Company is listed in active tax payers list b. Advance tax withheld by tenant is 15% for filer and 17.5% for non-filer. ABC Pvt. Ltd.: is a stationary manufacturing company. Calculate its tax payable for the year ended 30th June 2019: Income from business Rs ??? Rent received Rs. ??? PM Rental value of property determined by tax authorities Rs. /??? PM Advance (security) received on property Rs.??? Ground rent paid on property Rs. ??? Repair expenses on property Rs. ???, Collection charges paid on property Rs. ??? Administrative charges paid on property Rs. ??? Income from dividend Rs. ??? Insurance premium paid on property Rs. ??? Insurance premium paid on vehicle Rs. ??? Municipal tax paid Rs. ??? Unrealized rent Rs. ??? Amount paid to bank on borrowed money: a. Return of principal amount Rs. ??? b. Interest on borrowed amount Rs. ??? Lawyer fee paid to defend the title of property Rs. ??? Lawyer fee paid for personal case of CEO Rs. ??? a. Company is listed in active tax payers list b. Advance tax withheld by tenant is 15% for filer and 17.5% for non-filer

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts