Question: You purchase a call option for $6.48 with 20 weeks to expiration on a stock you expect to increase 40.00%. The strike price of the

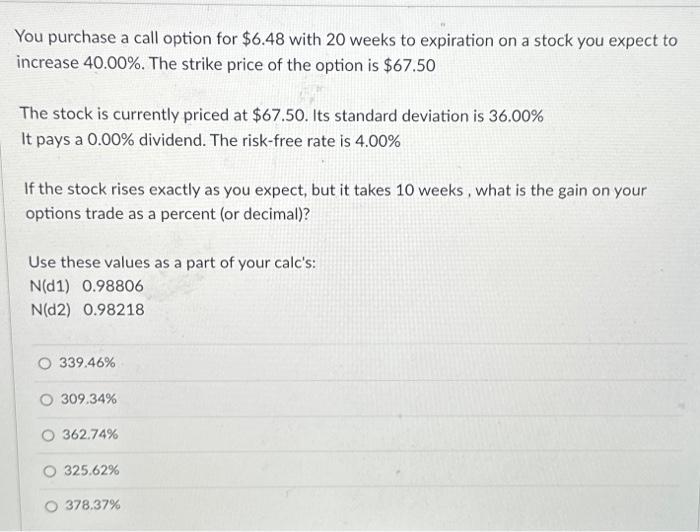

You purchase a call option for $6.48 with 20 weeks to expiration on a stock you expect to increase 40.00%. The strike price of the option is $67.50 The stock is currently priced at $67.50. Its standard deviation is 36.00% It pays a 0.00% dividend. The risk-free rate is 4.00% If the stock rises exactly as you expect, but it takes 10 weeks, what is the gain on your options trade as a percent (or decimal)? Use these values as a part of your calc's: N(d1)N(d2)0.988060.98218 339.46% 309.34% 362.74% 325.62% 378.37%

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock