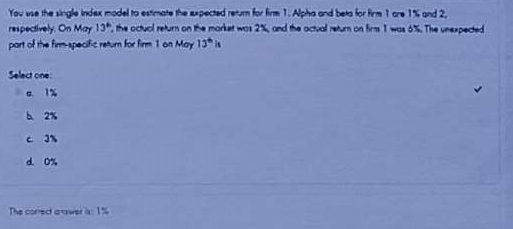

Question: You use the single index model to estimate the expected return for firm 1 . Alpha and Beta for firm 1 , are 1 %

You use the single index model to estimate the expected return for firm Alpha and Beta for firm are and respectively. On May th the actual return on the market was and the actual return on firm was The unexpected part of the firm specific return for firm on May th is write out the workings

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock