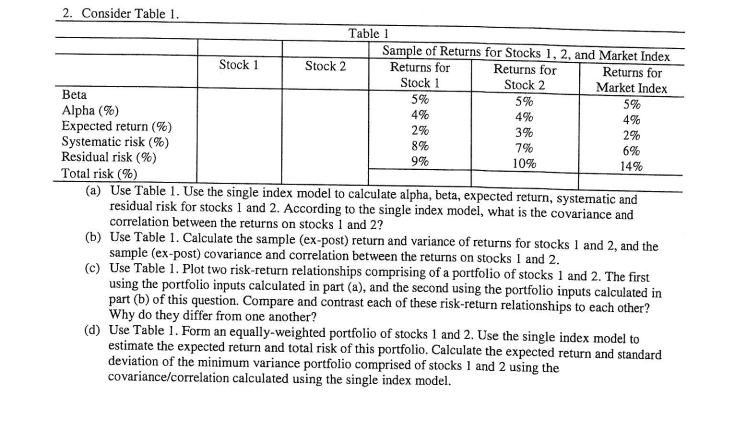

Question: 2. Consider Table 1. (a) Use Table 1. Use the single index model to calculate alpha, beta, expected return, systematic and residual risk for stocks

2. Consider Table 1. (a) Use Table 1. Use the single index model to calculate alpha, beta, expected return, systematic and residual risk for stocks 1 and 2 . According to the single index model, what is the covariance and correlation between the returns on stocks 1 and 2 ? (b) Use Table 1. Calculate the sample (ex-post) return and variance of returns for stocks 1 and 2, and the sample (ex-post) covariance and correlation between the returns on stocks 1 and 2 . (c) Use Table 1. Plot two risk-return relationships comprising of a portfolio of stocks 1 and 2. The first using the portfolio inputs calculated in part (a), and the second using the portfolio inputs calculated in part (b) of this question. Compare and contrast each of these risk-return relationships to each other? Why do they differ from one another? (d) Use Table 1. Form an equally-weighted portfolio of stocks 1 and 2. Use the single index model to estimate the expected return and total risk of this portfolio. Calculate the expected return and standard deviation of the minimum variance portfolio comprised of stocks 1 and 2 using the covariance/correlation calculated using the single index model. 2. Consider Table 1. (a) Use Table 1. Use the single index model to calculate alpha, beta, expected return, systematic and residual risk for stocks 1 and 2 . According to the single index model, what is the covariance and correlation between the returns on stocks 1 and 2 ? (b) Use Table 1. Calculate the sample (ex-post) return and variance of returns for stocks 1 and 2, and the sample (ex-post) covariance and correlation between the returns on stocks 1 and 2 . (c) Use Table 1. Plot two risk-return relationships comprising of a portfolio of stocks 1 and 2. The first using the portfolio inputs calculated in part (a), and the second using the portfolio inputs calculated in part (b) of this question. Compare and contrast each of these risk-return relationships to each other? Why do they differ from one another? (d) Use Table 1. Form an equally-weighted portfolio of stocks 1 and 2. Use the single index model to estimate the expected return and total risk of this portfolio. Calculate the expected return and standard deviation of the minimum variance portfolio comprised of stocks 1 and 2 using the covariance/correlation calculated using the single index model

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts