Question: 10. As we run the regression of American Standard Risk Premium on S&P Risk Premium, we got the following regression table: Intercept X Variable

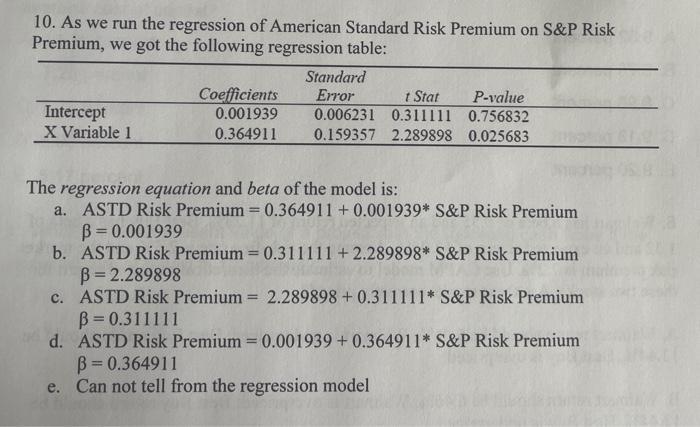

10. As we run the regression of American Standard Risk Premium on S&P Risk Premium, we got the following regression table: Intercept X Variable 1 Coefficients 0.001939 0.364911 Standard Error t Stat P-value 0.006231 0.311111 0.756832 0.159357 2.289898 0.025683 The regression equation and beta of the model is: a. ASTD Risk Premium = 0.364911 +0.001939* S&P Risk Premium B=0.001939 b. ASTD Risk Premium = 0.311111 +2.289898* S&P Risk Premium B= 2.289898 c. ASTD Risk Premium= 2.289898 +0.311111* S&P Risk Premium B=0.311111 d. ASTD Risk Premium = 0.001939 +0.364911* S&P Risk Premium B=0.364911 e. Can not tell from the regression model

Step by Step Solution

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step 1 Stock risk premium Alpha beta market risk premium ... View full answer

Get step-by-step solutions from verified subject matter experts