Question: Your R&D division has just synthesized a material that will superconduct electricity at room temperature; you have given the go ahead to try to produce

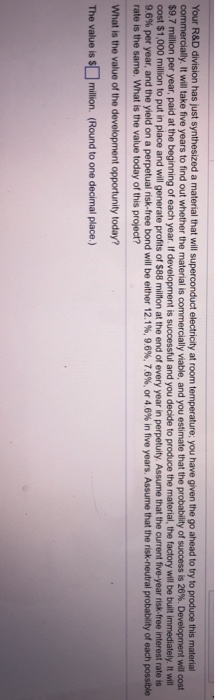

Your R&D division has just synthesized a material that will superconduct electricity at room temperature; you have given the go ahead to try to produce this material co n er ia y l wil take ve years find out whether the materal is commercially able, and you estimate that the probability of success is 26%. Deve m ent will cost $9.7 million per year, paid at the beginning of each year. If development is and you decide to produce the material, the factory will be built immediately. It will to put in place and will generate profits of $88 milfon at the end of every year in perpetuity. Assume that the current five-year risk-free interest rate is 9.6% per year and the yield on a perpetual nsk-free bond will be either 12.1%, 9 6%, 7.6%, or 4.6% in five years. Assume that the risk-neutral probability of each possible rate is the same. What is the value today of this project? What is the value of the development opportunity today? The value is S million. (Round to one decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts