Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Zanza Inc. uses the allowance method to account for its bad (uncollectible) accounts receivable. A selected ledger account and its December 1 balance are

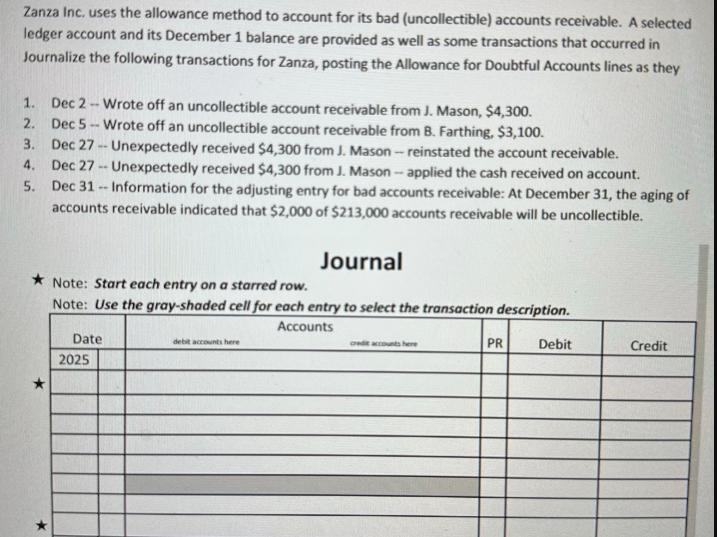

Zanza Inc. uses the allowance method to account for its bad (uncollectible) accounts receivable. A selected ledger account and its December 1 balance are provided as well as some transactions that occurred in Journalize the following transactions for Zanza, posting the Allowance for Doubtful Accounts lines as they 1. Dec 2- Wrote off an uncollectible account receivable from J. Mason, $4,300. 2. Dec 5-Wrote off an uncollectible account receivable from B. Farthing, $3,100. 3. Dec 27 4. Dec 27 Unexpectedly received $4,300 from J. Mason-reinstated the account receivable. Unexpectedly received $4,300 from J. Mason-applied the cash received on account. Information for the adjusting entry for bad accounts receivable: At December 31, the aging of accounts receivable indicated that $2,000 of $213,000 accounts receivable will be uncollectible. 5. Dec 31 Journal Note: Start each entry on a starred row. Note: Use the gray-shaded cell for each entry to select the transaction description. Date 2025 debit accounts here Accounts credit accounts here PR Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started