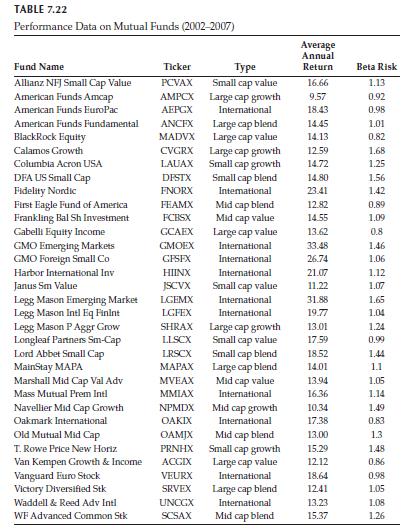

An investor has $250,000 to invest in mutual funds. She has selected 33 funds for possible investment.

Question:

An investor has $250,000 to invest in mutual funds. She has selected 33 funds for possible investment. In addition, a Federal money market fund is available for holding cash reserve. Table 7.22 gives the following data for each fund based on their 6-year performance, during 2002–2007:

i. Name of fund ii. Ticker symbol iii. Type of fund: capitalization size (small, medium, large), strategy

(value, growth, blend) or foreign iv. Average annual return (%)

v. Market risk (Beta)

Assume that any money not invested in the mutual funds can be deposited in a money market fund that will yield 3% interest at zero risk. Even though the investor is primarily interested in “growth” of her portfolio, she has the following investment restrictions:

i. No more than $25,000 should be invested in any one fund (does not apply to the money market fund).

ii. Between 15% and 30% of her total investment should be in “Mid Cap” funds.

iii. No more than 70% of her investment should be in “Large Cap”

and “Mid Cap” funds.

iv. At least 35% should be invested in “Large Cap” funds.

v. Investment in “International” funds should not exceed 30%.

vi. No more than 20% should be invested in “Small Cap” funds.

vii. Maintain a minimum cash reserve of $15,000 in the money market fund.

Questions

a. Develop the expressions for portfolio return and portfolio Beta risk.

b. Formulate a single-objective linear program (LP) for determining the optimal investment portfolio under the following criteria:

– Maximize portfolio return only

– Minimize portfolio risk only

c. Solve each of the LP problems formulated in part (b). Write down the optimal portfolios and their corresponding risk and return.

Determine the ideal solution and the bounds on return and risk.

d. Formulate and solve the LP problems to determine the optimal portfolios that will provide the minimum risk, under a portfolio return of at least R%, where R varies between the bounds obtained in part

(c) (vary R in increments of 2%). Plot a graph of return versus risk and identify the efficient portfolios.

e. Based on the results in part (d), what will be your recommended portfolio?

Step by Step Answer:

Service Systems Engineering And Management

ISBN: 978-0367781323

1st Edition

Authors: A. Ravi Ravindran ,Paul M. Griffin ,Vittaldas V. Prabhu