By 2018, there were roughly 5 billion mobile broadband subscribers in the world.1 As smartphones spread worldwide,

Question:

By 2018, there were roughly 5 billion mobile broadband subscribers in the world.1 As smartphones spread worldwide, so do mobile payment systems.

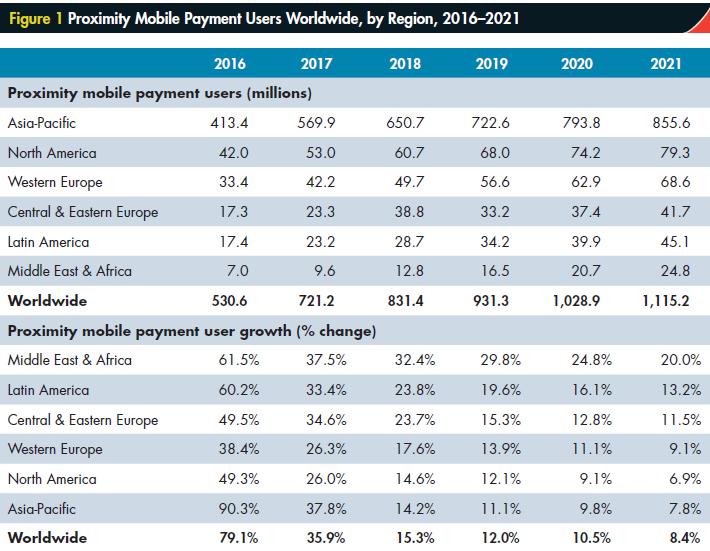

The fastest growth is in developing economies in Asia, Africa, and Latin America, where many people do not have credit cards or bank cards, and are transitioning directly from cash payments to mobile payments (see Figure 1).2 It is difficult to get a precise picture of worldwide mobile payment system use and estimates vary widely, but they are all large: from hundreds of billions to trillions of U.S. dollars. However, in 2018, there was no dominant mobile payment system standard, and a battle among competing mobile payment mechanisms and standards was unfolding.

Many large mobile payment systems such as Apple Pay, Samsung Pay, and Android Pay, use Near Field Communication (NFC) chips in smartphones. NFC chips enable communication between a mobile device and a point-of-sale system just by having the devices in close proximity.3 These systems transfer the customer’s information wirelessly, and then merchant banks and credit card systems such as Visa or MasterCard complete the transaction. These systems are thus very much like existing ways of using credit cards, but enable completion of the purchase without contact. In emerging markets such as Asia-Pacific and Latin America, where NFC-enabled smartphones are less common, mobile payment systems are more likely to use QR codes (machine readable bar codes), contactless stickers, and magnetic secure transmission (MST). MST sends a magnetic signal from a mobile device to a payment terminal.

The largest mobile payment system in the world, Alipay (owned by the Alibaba group in China) uses a system based on QR codes. With Alipay, a merchant generates a barcode at the point of sale, which the consumer scans with a smartphone. An application then shows the details of the transaction, and the consumer enters a pin to confirm payment. Alipay reports that by the end of 2017 it had 520 million active users.

Other competitors, such as Square (with Square Wallet) and PayPal, use a downloadable application and the Web to transmit a customer’s information. Square had gained early fame by offering small, free, credit card readers that could be plugged into the audio jack of a smartphone. These readers enabled vendors that would normally only take cash (street vendors, babysitters, etc.) to accept major credit cards.4 Square processed $30 billion in payments in 2014, making the company one of the fastest-growing tech startups in Silicon Valley.5 Square takes about 2.75 to 3 percent from each transaction it processes, but must split that with credit card companies and other financial institutions. In terms of installed base, however, PayPal had the clear advantage, with over 227 million active registered accounts by

year-end 2017. With PayPal, customers complete purchases simply by entering their phone numbers and a pin number, or use a PayPal-issued, magnetic- stripe card linked to their PayPal accounts. Users could opt to link their PayPal accounts to their credit cards, or directly to their bank accounts. PayPal also owned a service called Venmo, which enabled peer-to-peer exchanges with a Facebook-like interface that was growing in popularity as a way to exchange money without carrying cash.

Venmo charged a 3% fee if the transaction used a major credit card, but was free if the consumer used it with a major bank or debit card.....

Questions

1. What are some of the advantages and disadvantages of mobile payment systems in

(a) developed countries, and

(b) developing countries?

2. What are the key factors that differentiate the mobile payment systems? Which factors do consumers care most about? Which factors do merchants care most about?

3. Are there forces that are likely to encourage one mobile payment system to emerge as dominant?

If so, what do you think will determine which becomes dominant?

4. Is there anything the mobile payment systems can do to increase the likelihood of them becoming dominant?

5. How do these different mobile systems increase or decrease the power of

(a) banks, and

(b) credit cards?

Step by Step Answer:

Strategic Management Theory And Cases An Integrated Approach

ISBN: 9780357033845

13th Edition

Authors: Charles W. L. Hill, Melissa A. Schilling, Gareth R. Jones