T Ltd has owned 90% of the ordinary share capital of B Ltd for many years. Both

Question:

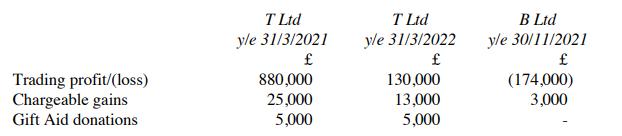

T Ltd has owned 90% of the ordinary share capital of B Ltd for many years. Both are UK resident. Recent results for the two companies are as follows:

No dividends have been received by either company in any of these years and maximum group relief is claimed. Calculate the corporation tax which is payable by each company for each accounting period and state the due date (or dates) of payment.

Transcribed Image Text:

Trading profit/(loss) Chargeable gains Gift Aid donations T Ltd yle 31/3/2021 880,000 25,000 5,000 T Ltd y/e 31/3/2022 130,000 13,000 5,000 B Ltd yle 30/11/2021 (174,000) 3,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (4 reviews)

Answered By

Ali Khawaja

my expertise are as follows: financial accounting : - journal entries - financial statements including balance sheet, profit & loss account, cash flow statement & statement of changes in equity -consolidated statement of financial position. -ratio analysis -depreciation methods -accounting concepts -understanding and application of all international financial reporting standards (ifrs) -international accounting standards (ias) -etc business analysis : -business strategy -strategic choices -business processes -e-business -e-marketing -project management -finance -hrm financial management : -project appraisal -capital budgeting -net present value (npv) -internal rate of return (irr) -net present value(npv) -payback period -strategic position -strategic choices -information technology -project management -finance -human resource management auditing: -internal audit -external audit -substantive procedures -analytic procedures -designing and assessment of internal controls -developing the flow charts & data flow diagrams -audit reports -engagement letter -materiality economics: -micro -macro -game theory -econometric -mathematical application in economics -empirical macroeconomics -international trade -international political economy -monetary theory and policy -public economics ,business law, and all regarding commerce

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

The person working on task C tells the project manager he can't start work until one day after the scheduled starting date. What impact would this have on the completion date of the project? Why? 2....

-

Farnsworth Television makes and sells portable television sets. Each television regularly sells for $200 and has the following costs. Direct materials, Direct labor. Manufacturing overhead 75%...

-

Raider Company manufactures and sells multiple products. The traditional costing system allocates overhead costs based on direct labor hours, while the company is considering transitioning to an...

-

A 3-m3 tank contains saturated air at 25C and 97 kPa. Determine (a) The mass of the dry air, (b) The specific humidity, and (c) The enthalpy of the air per unit mass of the dry air.

-

Which of these statements about alloys and intermetallic compounds is false? (a) Bronze is an example of an alloy. (b) Alloy is just another word for a chemical compound of fixed composition that is...

-

Refer to Googles financial statements in Appendix A to compute its equity ratio as of December 31, 2015, and December 31, 2014. Data From Google Financial Statement Appendix A Google Inc....

-

Telly Savalas owns the Bonita Barber Shop. He employs four barbers and pays each a base rate of $1,000 per month. One of the barbers serves as the manager and receives an extra $500 per month. In...

-

Calculate the dividends paid per share of common stock. ( Note: Number of shares shown on balance sheet is not shown in thousands. The number of shares " in thousands" is 2 , 0 0 0 . ) Round...

-

Lois Griffon, 36 years old, is a senior IT programmer with the Calgary Board of Education at its head office, downtown, at Macleod Trail and 5th Ave SE. Her husband, Peter, is 33 years of age and is...

-

Classify each of the following supplies as either taxable at the standard rate, taxable at the reduced rate, taxable at the zero rate or exempt: (a) (c) a theatre ticket bank charges (e) a taxi ride...

-

The ordinary share capital of PP Ltd (a trading company) is owned 32% by QQ Ltd, 35% by RR Ltd and 23% by SS Ltd. The remaining 10% is owned by various individuals, none of whom own more than 1%. All...

-

Does temperature affect the distance that golf balls travel? A Florida golfer decided to try to answer the question. Over the course of a year he measured the distance his drive traveled on a...

-

Your client owns a condominium that they purchased for $460,000 in 2009. It is assessed for real estate tax purposes at $506,000, and its replacement value for insurance purposes in now $580,000. The...

-

1 . State five ( 5 ) reasons for the differences in national accounting standards 2 . What are International Financial Reporting Standards ( IFRSs ) ? 3 . Many countries are adopting IFRSs although...

-

Claire a student, sold a piece of land to Max on October 1 , Year 1 . Claire's basis in the land was $ 1 5 0 , 0 0 0 and Max purchased it from her for $ 1 , 5 0 0 , 0 0 0 ( payable in three annual...

-

There are specific rules that apply to issuing and completing the Record of Employment ( ROE ) for commission employees who are paid by commission only. In your own words, explain how to complete...

-

What is Accounting Seed software, and why is this AIS software said to be not helpful for retail stores but used in warehouses or any finance department? Give reference.

-

Searching for Deadwood Many writers and speakers are unaware of deadwood phrases they use. Some of these are redundancies, compound prepositions, or trite business phrases. Your Task. Using your...

-

Draw the major product for each of the following reactions: (a) (b) (c) 1) 9-BBN 2) H2O2, NaOH 1) Disiamylborane 2) H20, NaOH

-

(a) Define the term "borrowing costs" and explain the accounting treatment of such costs which is required by international standard IAS23.(b) During the year to 31 December 2022, a company started...

-

Whilst preparing financial statements for the year to 30 June 2023, a company discovers that (owing to an accounting error) the sales figure for the year to 30 June 2022 had been understated by...

-

The statement of financial position of Urbax plc at 31 July 2024 (with comparatives for the previous year) is shown below:Statement of financial position at 31 July 2024 (i) Equipment which had cost...

-

Solve this for x and y; 4x^3 - 4y = 0 4y^3 - 4x = 0

-

1 Euro is currently trading at 38 Thai Baht. 1 Thai Baht is currently trading at .04 Canadian Dollar. If triangular arbitrage holds, the value of the Euro in terms of the Canadian Dollar is ____?...

-

Suppose someone wants to accumulate $40,000 for a college fund over the next 15 years. Determine whether the following investment plans will allow the person to reach the goal. Assume the compounding...

Study smarter with the SolutionInn App