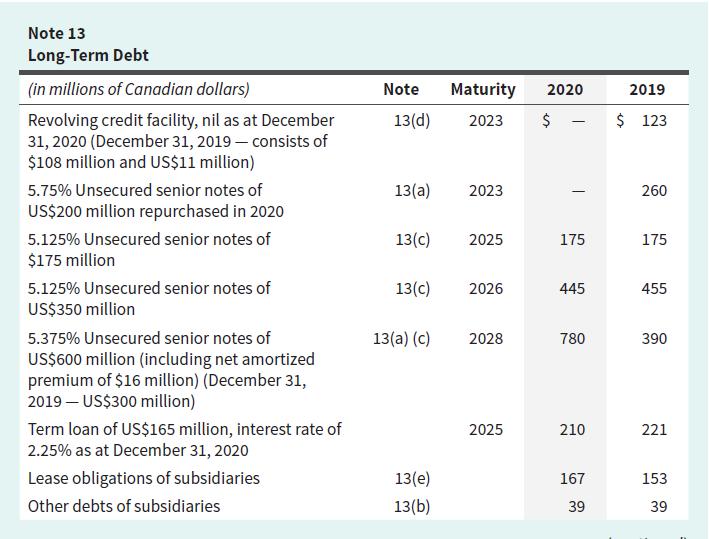

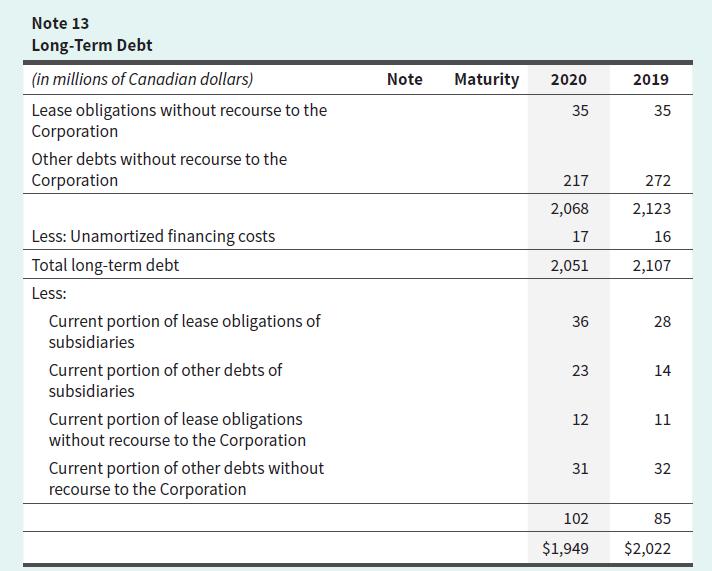

Cascades Inc. produces and markets packaging and tissue products. Exhibit 10.10 contains Note 13 from the companys

Question:

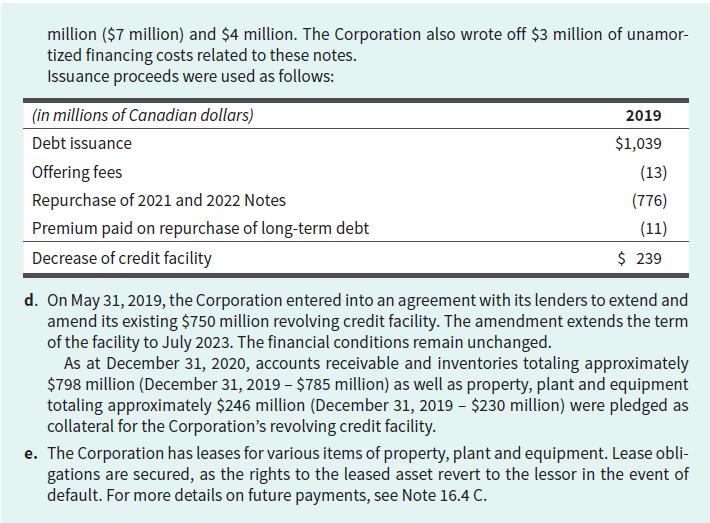

Cascades Inc. produces and markets packaging and tissue products. Exhibit 10.10 contains Note 13 from the company’s 2020 annual report detailing long-term debt. Amounts are in millions of dollars.

Required

a. Cascades had a $750-million revolving credit facility in place at December 31, 2020. What is a revolving credit facility?

b. What amount of the revolving credit facility had been used at December 31, 2020? Was the revolving credit facility secured, and, if so, what assets had been pledged as security?

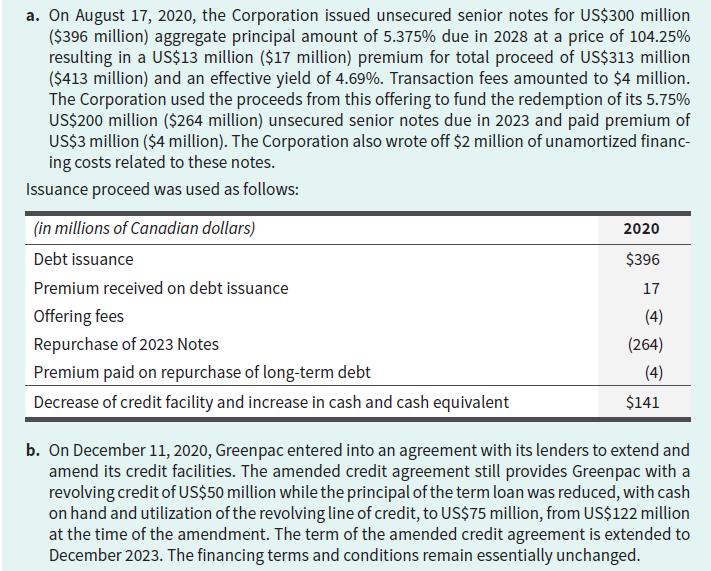

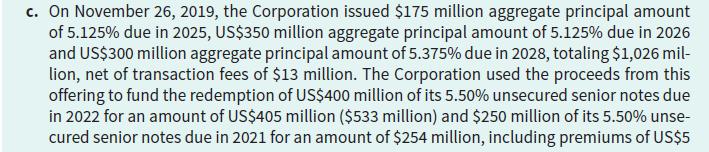

c. In 2020, Cascades issued unsecured senior notes for U.S. $300 million at 104.25%. Does this mean that the notes were issued at a premium or a discount? Explain what this means in terms of how the company’s interest expense on these notes will compare to the cash payments made to the note holders.

d. Cascades used part of the proceeds of its 2020 U.S. $300-million note issuance to repay U.S.n$200 million in other notes that had an interest rate of 5.55%. Determine the interest costs that Cascades would save on an annual basis from doing this.

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119715474

3rd Canadian Edition

Authors: Christopher D. Burnley