The management of Hencky Corporation is developing a loan proposal to present to a local investor. The

Question:

The management of Hencky Corporation is developing a loan proposal to present to a local investor. The company is looking for a $1-million loan to finance the research and development costs of producing a revolutionary new wearable computer. Most of the loan proceeds will be spent on intangible costs, such as research salaries, and this will therefore be a very risky investment. Because of the risk associated with the project, the investor is requiring some assurance that the company is currently solvent and operating as a going concern.

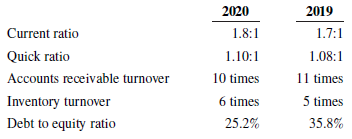

As the accountant for Hencky Corporation, you have used the most recent financial statements to calculate the following ratios:

Required

Provide an explanation of how each of the above ratios should be interpreted and what they specifically tell you about Hencky’s solvency and ability to continue as a going concern.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Solvency

Solvency means the ability of a business to fulfill its non-current financial liabilities. Often you have heard that the company X went insolvent, this means that the company X is no longer able to settle its noncurrent financial... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley