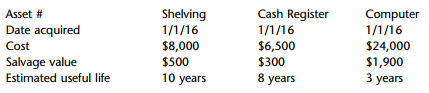

Question: Snicks Board Shop owned the fixed assets shown below as of December 31, 2018: You are to create Snicks fixed asset depreciation worksheets using the

You are to create Snick€™s fixed asset depreciation worksheets using the straight-line depreciation method and based on the information in the preceding table. No summary sheet is required. Individual assets must show depreciation over their entire useful life. Follow the text examples for formatting. Label each worksheet Shelving SL, Cash Register SL, and Computer SL.

In the same workbook, create Snick€™s fixed asset depreciation worksheets using the double declining balance method and based on the same table. No summary sheet is required. Individual assets must show depreciation over their entire useful life. Follow the text examples for formatting. Label each worksheet Shelving DDB, Cash Register DDB, and Computer DDB.

In the same workbook, create Snick€™s fixed asset depreciation worksheets using the sum-of-the-year€™s-digits method and based on the same table. No summary sheet is required. Individual assets must show depreciation over their entire useful life. Follow the text examples for formatting. Label each worksheet Shelving SYD, Cash Register SYD, and Computer SYD. In the same workbook, you should now create a chart of each asset€™s depreciation that compares the straight-line, double declining balance, and sum-of-the-year€™s digits methods of calculating depreciation. Label each worksheet Shelving Chart, Cash Register Chart, and Computer Chart. Choose any line chart and chart layout that you like.

Save the workbook as ch4-05_student_name (replacing student_name with your name). Print all worksheets in Value view, with your name and date printed in the lower left footer and the file name in the lower right footer.

Cash Register 1/1/16 Asset # Date acquired Cost Salvage value Estimated useful life Shelving Computer 1/1/16 1/1/16 $8,000 $6,500 $300 8 years $24,000 $1,900 $500 10 years 3 years

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Snicks Board Shop Depreciation Schedule Asset Shelving Date acquired 112016 Cost 800000 Depreciation method SL Salvage value 50000 Estimated useful life 10 Year Depreciation Expense Accumulated Deprec... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

1512_6052e8e6161d7_679986.xlsx

300 KBs Excel File