Question: Prepare the cash flow statement and all required disclosures for Barrys Clothing Stores, Inc. from P22-11 using the direct method. In P22-11 Barrys Clothing Stores,

Prepare the cash flow statement and all required disclosures for Barry’s Clothing Stores, Inc. from P22-11 using the direct method.

In P22-11

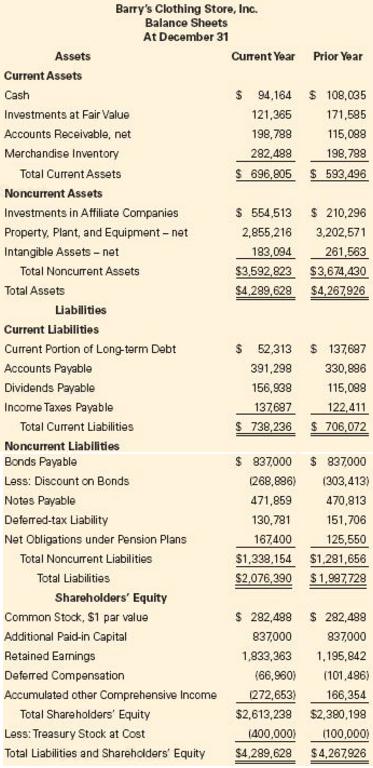

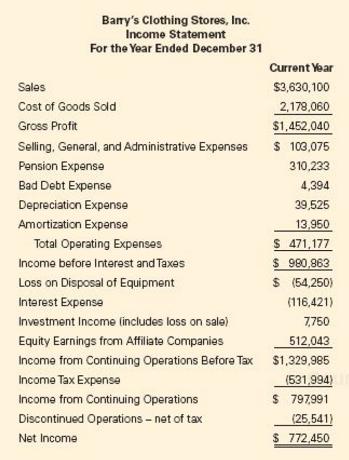

Barry’s Clothing Stores, Inc. released its annual report for the current year and included the following comparative balance sheets and income statement.

.

.

Barry's Clothing Store, Inc. Balance Sheets At December 31 Assets Current Year Prior Year Current Assets Cash Investments at Fair Value Accounts Receivable, net Merchandise inventony $ 94,164 $ 108,035 171,585 115,088 198,789 S 696,805 S 593,496 121,365 198,788 282,488 Total Curment Assets Noncurrent Assets Investments in Affiliate Companies Property, Plant, and Equipment- net Intangible Assets-net S 554,513 210,296 2,855,216 3,202,571 261,563 $3,592,823 $3,674430 $4,289,628 $4,267926 193,094 Total Noncurrent Assets Total Assets Liabilities Current Liabilities Current Portion of Long-term Debt Accounts Payable Dividends Payable Income Taxes Payable S 52,313 S 137687 391,298 330886 115,088 137697 122,411 S 738,236 706.072 156,938 Total Curent Liabilities Noncurrent Liabilities Bonds Payable Less: Discount on Bonds Notes Payable Deferred-tax Liability Net Obligations under Pension Plans $ 937000 837000 268,886) 303,413 470,813 151,706 125,550 $1,338,154 $1,281,656 $2,076,390 $1,987728 471,859 130,781 167,400 Total Noncurrent Liabilities Total Liabilities Shareholders' Equity Common Stock, $1 par value Additional Paid-in Capital Retained Earnings Deferred Compensation Accumulated other Comprehensive Income S 282,488 282,488 837000 1,833,363 .195,842 (66,960 101,486) 272653166.354 $2,613,238 $2,380,198 (400,000) 100,000) Total Liabilities and Shareholders Equity$4.289.629 $4267926 937000 Total Shareholders Equity Less: Treasury Stock at Cost Barry's Clothing Stores, Inc. Income Statement For the Year Ended December 31 Current Year $3,630,100 2,178,060 $1,452,040 S 103,075 310,233 4,394 39,525 13,950 471.177 990 863 $ (54,250) 116,421) 7,750 512,043 Income from Continuing Operations Before Tax $1,329,985 (531.994 $ 797991 541 S 772.450 Sales Cost of Goods Sold Gross Profit Selling, General, and Administrative Expenses Pension Expense Bad Debt Expense Depreciation Expense Amortization Expense Total Operating Expenses Income before Interest and Taxes Loss on Disposal of Equipment Interest Expense Investment Income (includes loss on sale) Equity Earnings from Affiliate Companies Income Tax Expense Income from Continuing Operations Discontinued Operations net of tax Net Income

Step by Step Solution

3.41 Rating (164 Votes )

There are 3 Steps involved in it

The first step in the solution is to isolate all balance sheet changes and classify the changes as operating investing or financing Analysis of Balance Sheet Changes and Cash Flow Classification Asset... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

578-B-A-B-S-C-F (1975).docx

120 KBs Word File