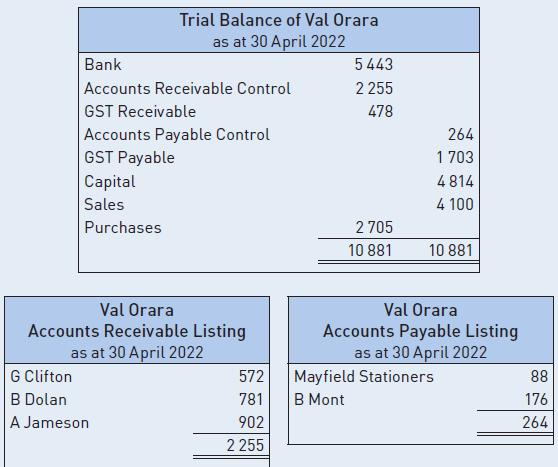

Using the information of Val Orara at the end of April 2022 (shown in figure 6.90) and

Question:

Using the information of Val Orara at the end of April 2022 (shown in figure 6.90) and the transactions for May:

• enter the appropriate journal abbreviation next to each transaction

• prepare the relevant journals for the month of May 2022

• enter the opening balances in the appropriate ledgers

• post the journals to the general ledger in T account format, and the accounts receivable and accounts payable ledgers in columnar account format

• prepare a trial balance from the general ledger, and

• prepare accounts receivable and payable listings that balance with the respective accounts in the general ledger.

1 Received funds from B Dolan $781.

__________ 1 A Jameson direct deposited funds for April invoices less $33 discount.

__________ 1 Electronic transfer to B Mont $176 for last month’s account.

__________ 2 Direct deposit from G Clifton for $550 received in full settlement of April invoices.

__________ 7 Received tax invoice for $297 ($270 + $27 GST) from A Waratah for inventory.

__________13 Photocopy paper (stationery expense) $165 ($150 + $15 GST) received from Mayfield Stationers.

__________15 Sold goods to B Dolan $2156 ($1960 + $196 GST).

__________16 Inventory purchased $187 ($170 + $17 GST) from B Mont.

__________16 Sent tax invoice for $2211 ($2010 + $201 GST) to R Daley for stock delivered.

__________18 A Jameson purchased $2057 ($1870 + $187 GST) of stock.

__________ 19 Adjustment credit note received from B Mont $33 ($30 + $3 GST) for damaged inventory.

__________ 20 Mailed adjustment credit note for $44 ($40 + $4 GST) to A Jameson for overcharge.

__________ 21 Purchased inventory on credit from A Waratah $374 ($340 + $34 GST).

__________ 21 Cash sales $2563 ($2330 + $233 GST).

__________ 25 Tax invoice received for $407 ($370 + $37 GST) from B Mont for inventory.

__________ 25 Tax invoice for 12 months insurance for $363 ($330 + $33 GST) from A Merewether.

__________ 26 Val Orara returned goods to B Mont $55 ($50 + $5 GST).

__________ 28 Tax invoice $1419 ($1290 + $129 GST) mailed to G Clifton for inventory.

Step by Step Answer:

Accounting An Introduction To Principles And Practice

ISBN: 9780170403832

9th Edition

Authors: Edward A. Clarke, Michael Wilson