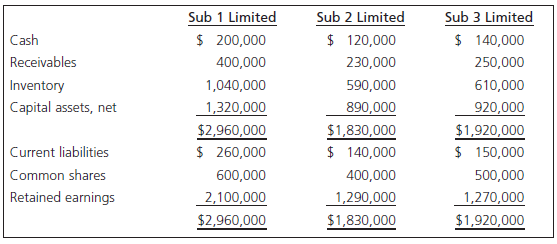

Big Limited has three subsidiaries, all 80% owned, and, at December 31, 20X5, they have the following

Question:

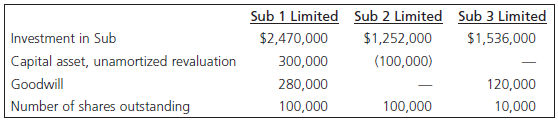

Selected SFP information of Big Limited as at December 31, 20X5, with respect to each subsidiary, is as follows:

The investment in Sub account for each subsidiary is kept on the equity basis and includes all entries for 20X5, with the exception of the following.

On the last day of the year, after all the accounts had been brought up to date but before the closing entries had been made, the subsidiaries had the following transactions:

1. Sub 1 Limited issued a 100% stock dividend to all common shareholders.

2. Sub 2 Limited issued shares equal to 10%, or 10,000 shares of the present outstanding amount, to the non-controlling interest shareholders for $38 per share.

3. Sub 3 Limited purchased and retired 10% or 1,000 shares of the outstanding shares from the non-controlling interest for a price of $150 per share. Big Limited will consolidate the subsidiaries but has kept the investment in subsidiary accounts on the equity basis.

Required

Considering that the parent company is using the equity method for its investment in subsidiary accounts, prepare a separate journal entry(ies) to record the above events for each subsidiary on the parent company€™s books. If no journal entry on the parent€™s books is needed, explain why. Indicate any gain or loss that would appear on the consolidated financial statements. If no gain or loss is present, explain why. Support your answer fully.

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Advanced Financial Accounting

ISBN: 978-0132928939

7th edition

Authors: Thomas H. Beechy, V. Umashanker Trivedi, Kenneth E. MacAulay