P Co acquired a controlling interest of 90% in X Co. The financial statements of P Co

Question:

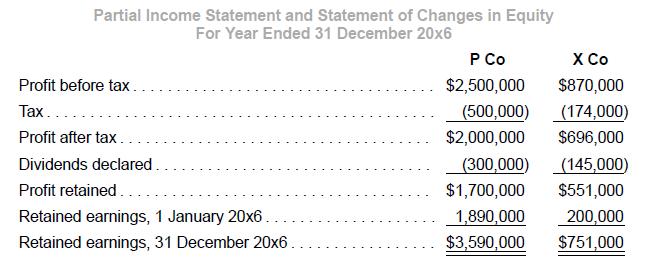

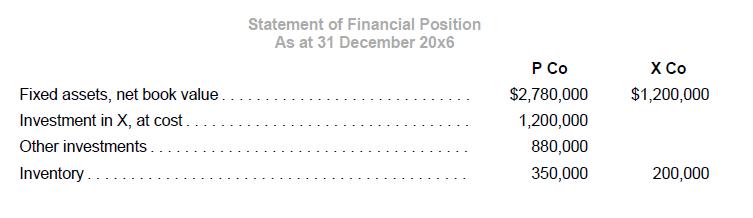

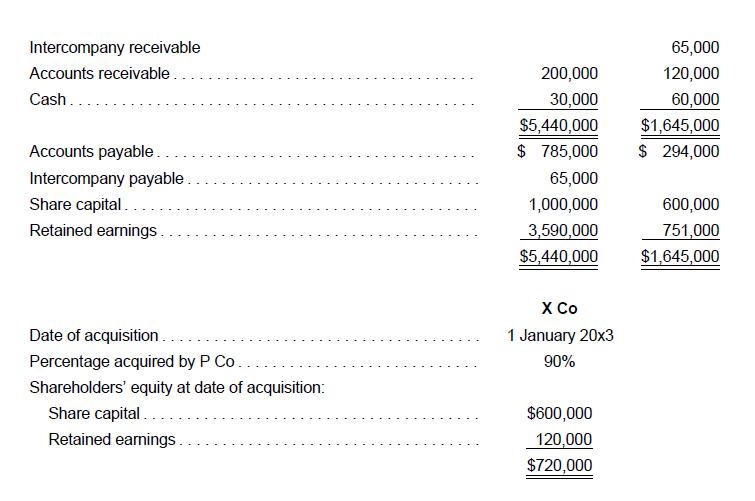

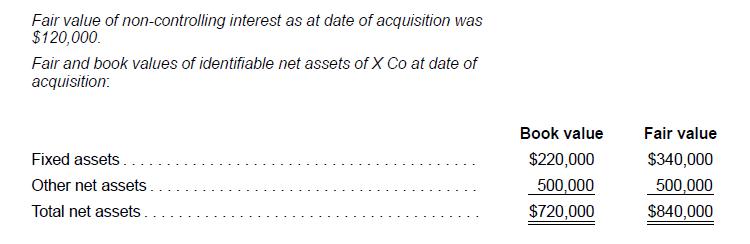

P Co acquired a controlling interest of 90% in X Co. The financial statements of P Co and X Co and other relevant details are shown below:

Additional information:

(a) The fixed assets of X Co as at the date of acquisition had a remaining life of six years. On 1 January 20x6, as result of technical enhancement, the remaining useful life was revised to five years.

(b) On 1 January 20x6, X Co transferred excess fixed assets to P Co at the transfer price of $300,000. The original cost of the fixed assets was $260,000 and the accumulated depreciation was $124,800. The original useful life was five years and the estimated remaining useful life at transfer date was three years.

Residual value was negligible.

(c) P Co sold inventory to X Co on 15 December 20x6 at a transfer price of $50,000. The original cost as carried in P Co’s books prior to the transfer was $53,000. Fair value of the inventory at transfer date was $55,000.

Sixty percent of the inventory remained unsold as at 31 December 20x6. Fair values remained stable after the transfer date.

(d) Tax rate was 20% throughout. Recognize tax effects on fair value adjustments.

Required

1. Prepare consolidation entries for the year ended 31 December 20x6, with narratives (brief headers) and workings in accordance with IFRS 3 and IFRS 10.

2. Perform an analytical check on the balance of non-controlling interests as at 31 December 20x6, showing the workings clearly.

3. Perform an analytical check on the following consolidated amounts. Show workings clearly. (Derive the consolidated balance through a compilation of relevant CJEs and analytically check this number through an independent and logical process):

a. Consolidated fixed assets as at 31 December 20x6.

b. Consolidated inventory as at 31 December 20x6

c. Consolidated retained earnings as at 1 January 20x6.

d. Consolidated retained earnings as at 31 December 20x6.

Step by Step Answer:

Advanced Financial Accounting An IFRS Standards Approach

ISBN: 9781285428765

4th Edition

Authors: Pearl Tan, Chu Yeong Lim, Ee Wen Kuah