Given a risk-free rate (rÌ f ) of 6 percent and a market risk premium (rÌ m

Question:

a. American Electric Power

b. Citigroup

c. General Mills

d. Wynn Resorts

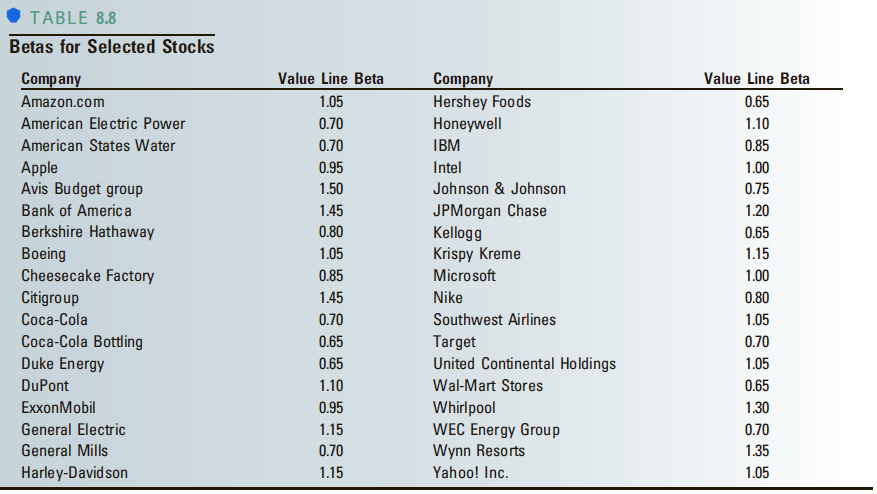

TABLE 8.8 Betas for Selected Stocks Company Value Line Beta Company Hershey Foods Honeywell Value Line Beta 1.05 Amazon.com 0.65 American Electric Power 0.70 1.10 American States Water 0.70 IBM 0.85 0.95 Apple Avis Budget group Intel 1.00 Johnson & Johnson 1.50 0.75 JPMorgan Chase Kellogg Krispy Kreme Bank of America 1.45 1.20 Berkshire Hathaway 0.80 0.65 Boeing Cheesecake Factory 1.05 1.15 0.85 Microsoft 1.00 Citigroup Nike 0.80 1.45 Coca-Cola 0.70 Southwest Airlines 1.05 Coca-Cola Bottling Duke Energy 0.65 Target United Continental Holdings 0.70 0.65 1.05 DuPont 0.65 1.10 Wal-Mart Stores 0.95 ExxonMobil Whirlpool WEC Energy Group Wynn Resorts 1.30 General Electric 1.15 0.70 General Mills 0.70 1.35 Harley-Davidson 1.15 Yahoo! Inc. 1.05

Step by Step Answer:

a kj 006 0082bj 006 008...View the full answer

Contemporary Financial Management

ISBN: 978-1337090582

14th edition

Authors: R. Charles Moyer, James R. McGuigan, Ramesh P. Rao

Related Video

Stocks (also known as equities) are securities that represent ownership in a company. They are issued by companies to raise capital, and when an individual buys stocks, they become a shareholder in that company. Investing in stocks can be a way for individuals to potentially earn a return on their investment through dividends and capital appreciation. However, investing in stocks also carries a level of risk, as the value of the stock can fluctuate based on various factors such as the financial performance of the company and general market conditions. For companies, issuing stocks can be a way to raise funds for growth and expansion. When a company goes public by issuing an initial public offering (IPO), it can raise significant capital by selling ownership stakes to the public. Companies can also issue additional stock offerings to raise additional capital as needed.

Students also viewed these Business questions

-

Given a risk free rate of 5%, a market return of 15%, and the information for stocks A and B in the following table, determine if stock A and stock B are undervalued or overvalued if they are valued...

-

Look again at Table 9.1. This time we will concentrate on Burlington Northern. a. Calculate Burlingtons cost of equity from the CAPM using its own beta estimate and the industry beta estimate. How...

-

Estimating the capital asset pricing model (CAPM). In Section 6.1 we considered briefly the well-known capital asset pricing model of modern portfolio theory. In empirical analysis, the CAPM is...

-

Consider a situation with two firms that have marginal abatement cost functions The marginal damage function is again equal to D'(E)=d.E. Assume the regulator applies Monteros mechanism. Determine...

-

A closed model for an economy identifies government, the profit sector, the nonprofit sector, and households as its industries. Each unit of government output requires 0.3 unit of government input,...

-

A ball is thrown horizontally from a height of 20m and hits the ground with a speed that is three times its initial speed. What is the initial speed?

-

Describe the staffing process in an MNE. How does it differ from that of a domestic-only corporation?

-

A professor has learned that three students in her class of 20 will cheat on the exam. She decides to focus her attention on four randomly chosen students during the exam. a. What is the probability...

-

Use the Following metrics to perform the operation, if possible. A = F2-12 1 3 0 1 2 3 B 1 1 2 3 5 3-3 L0323 Find 2A-3B

-

McGee Carpet and Trim installs carpet in commercial offices. Andrea McGee has been very concerned with the amount of time it took to complete several recent jobs. Some of her workers are very...

-

How does the basic net present value capital budgeting model deal with the phenomenon of increasing risk of project cash flows over time?

-

What is Cheerios doing to compete successfully in the maturity stage? Go to its Web site ( www.cheerios.com ) to find out?

-

In Problems 64 and 65 you are given the equation used to solve a problem. For each of these, you are to 60 N = (0.30 kg) 2 (0.50 m) a. Write a realistic problem for which this is the correct...

-

A basketball player is trying to improve his consecutive free throw shots. Every day, he would shoot a set of ten free throws and record the results. He has been shooting shots all summer and...

-

calculate the problem with advanced simplex method max s. t. 2x16x2 -#1 - 2 - 3 < -2 2012 +3 1 1, 2, 30

-

How has the market's perception of the company evolved? -What are the market's expectations for the company's future in 2020? -How has the solvency evolved? -Is the financial structure risky? What is...

-

It is stated that if all variables in a Bayesian network are binary, the probability distribution over some variable X with n parents PaX can be represented by 2n independent parameters. Imagine that...

-

There is a dwarfing allele (D) in White Leghorn chickens, which reduces body size from 5 lbs (DD, DD) to 3 lbs (DD) on average. There is also a reduction in the annual egg production from 290...

-

What is the rate of return on an investment or the interest rate on a loan and how do you calculate the rate?

-

Use the formula to determine the value of the indicated variable for the values given. Use a calculator when one is needed. When necessary, use the key on your calculator and round answers to the...

-

How do money and capital markets differ?

-

Describe the various types of financial intermediaries, including the sources of their funds and the types of investments they make.

-

What factors need to be considered when determining the optimal form of organization for a business enterprise?

-

Can you elucidate the principles underlying genome organization and chromatin structure, including the roles of topologically associating domains (TADs) and chromosomal territories in gene regulation...

-

State three ways of using artificial intelligence and machine learning in marketing and explain each use case with two examples.

-

discuss the principles of population genetics, including allele frequency distributions, Hardy-Weinberg equilibrium, genetic drift, and natural selection, and how these concepts inform our...

Study smarter with the SolutionInn App