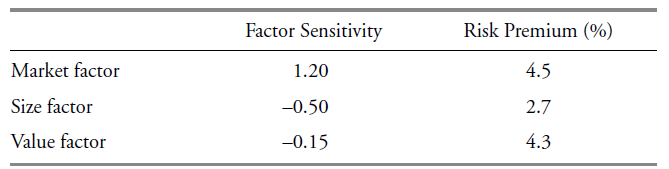

The estimated factor sensitivities of TerraNova Energy to Fama - French factors and the risk premia associated

Question:

A. Based on the Fama - French model, calculate the required return for TerraNova Energy using these estimates. Assume that the Treasury bill rate is 4.7 percent.

B. Describe the expected style characteristics of TerraNova based on its factor sensitivities.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Equity Asset Valuation

ISBN: 978-0470571439

2nd Edition

Authors: Jerald E. Pinto, Elaine Henry, Thomas R. Robinson, John D. Stowe, Abby Cohen

Question Posted: