Information from the annual report of Hicks Company (a fictional company) to shareholders follows: Required: 1. Suppose

Question:

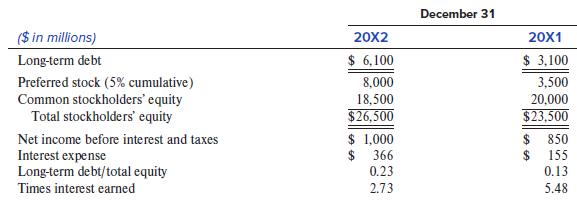

Information from the annual report of Hicks Company (a fictional company) to shareholders follows:

Required:

1. Suppose that the increase in the preferred stock account was due to the issuance of new preferred shares at par on January 1, 20X2. What journal entry would the company make on the date to record the new preferred stock?

2. What journal entry would the company make to record preferred dividends for 20X2 and 20X1?

3. Suppose that Hicks had issued 8% debt (at par) rather than any preferred stock. What journal entry would the company make to record interest on the debt for 20X2 and 20X1?

4. Compute the company’s long-term-debt-to-total-equity ratio and its interest coverage ratio for 20X2 and 20X1 as if Hicks had issued 8% debt rather than preferred stock.

5. Lenders generally do not restrict a company’s ability to raise more equity capital. That’s because the dollars raised from selling stock provide a cash cushion that protects the lender’s debt claim. Under what conditions might lenders want to limit a company’s ability to issue preferred stock?

6. How would the preferred stock be shown on the company’s balance sheet if the shares contained a mandatory redemption feature?

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer