Southwest Airlines Co. is a major airline that operates in the United States. Refer to the following

Question:

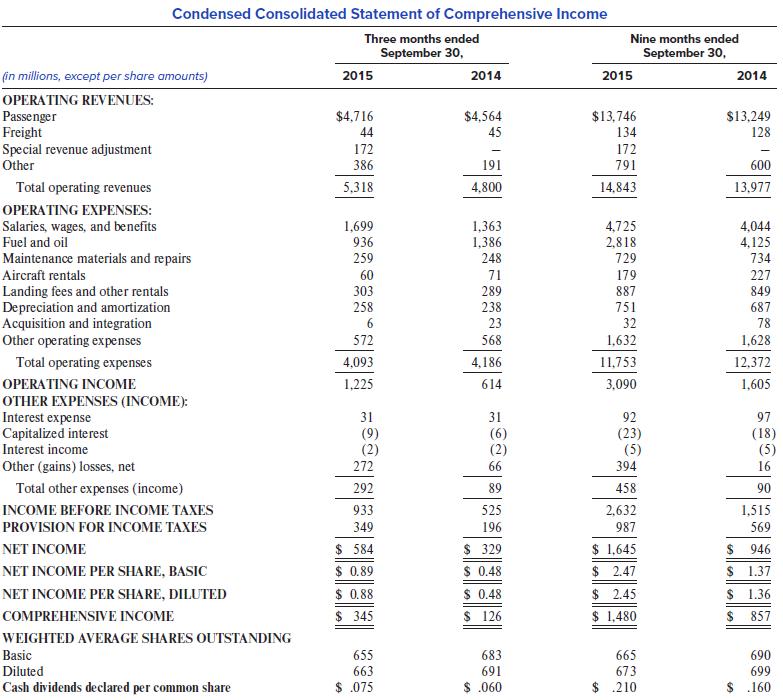

Southwest Airlines Co. is a major airline that operates in the United States. Refer to the following information from Southwest Airlines’s 2015 3rd quarter 10-Q.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

3. FINANCIAL DERIVATIVE INSTRUMENTS

Fuel contracts

Airline operators are inherently dependent upon energy to operate and, therefore, are impacted by changes in jet fuel prices. Furthermore, jet fuel and oil typically represent one of the largest operating expenses for airlines. The Company endeavors to acquire jet fuel at the lowest possible cost and to reduce volatility in operating expenses through its fuel hedging program. Although the Company may periodically enter into jet fuel derivatives for short-term time frames, because jet fuel is not widely traded on an organized futures exchange, there are limited opportunities to hedge directly in jet fuel for time horizons longer than approximately 24 months into the future. However, the Company has found that financial derivative instruments in other commodities, such as West Texas Intermediate (“WTI”) crude oil, Brent crude oil, and refined products, such as heating oil and unleaded gasoline, can be useful in decreasing its exposure to jet fuel price volatility. The Company does not purchase or hold any financial derivative instruments for trading or speculative purposes.

The Company has used financial derivative instruments for both short-term and long-term time frames and primarily uses a mixture of purchased call options, collar structures (which include both a purchased call option and a sold put option), call spreads (which include a purchased call option and a sold call option), put spreads (which include a purchased put option and a sold put option), and fixed price swap agreements in its portfolio. Although the use of collar structures and swap agreements can reduce the overall cost of hedging, these instruments carry more risk than purchased call options in that the Company could end up in a liability position when the collar structure or swap agreement settles. With the use of purchased call options and call spreads, the Company cannot be in a liability position at settlement, but does not have coverage once market prices fall below the strike price of the purchased call option. The Company evaluates its hedge volumes strictly from an “economic” standpoint and thus does not consider whether the hedges have qualified or will qualify for hedge accounting. The Company defines its “economic” hedge as the net volume of fuel derivative contracts held, including the impact of positions that have been offset through sold positions, regardless of whether those contracts qualify for hedge accounting. The level at which the Company is economically hedged for a particular period is also dependent on current market prices for that period, as well as the types of derivative instruments held and the strike prices of those instruments. For example, the Company may enter into “out-of-themoney” option contracts (including catastrophic protection), which may not generate intrinsic gains at settlement if market prices do not rise above the option strike price. Therefore, even though the Company may have an “economic” hedge in place for a particular period, that hedge may not produce any hedging gains at settlement and may even produce hedging losses depending on market prices, the types of instruments held, and the strike prices of those instruments.

For the three months ended September 30, 2015, the Company had fuel derivative instruments that settled. Although a portion of these instruments finished “out of the money” and did not result in a payment to or from the counterparty at settlement, the instruments in place could have represented an “economic” hedge for up to 43 percent of its fuel consumption if prices had increased to significantly higher levels. During third quarter 2015, the Company reduced its hedge position related to future periods. This reduction in the Company’s hedge position primarily was accomplished through entering into offsetting derivatives that will also settle in the same periods as the economic hedge derivative. Prior to third quarter 2015, the Company had paid $39 million to counterparties to purchase offsetting derivatives that also settled during third quarter 2015. These transactions are reflected in the total economic fuel hedge settlement losses of $245 million recognized in Fuel and oil expense during third quarter 2015. The Company also paid $294 million to counterparties during third quarter 2015 to purchase offsetting derivatives that will settle in fourth quarter 2015 and first half 2016. Therefore, as of September 30, 2015, the Company no longer had an “economic” hedge in place for its remaining 2015 estimated fuel consumption. However, in periods prior to third quarter, the Company did have fourth quarter 2015 hedges in place that were subsequently offset.

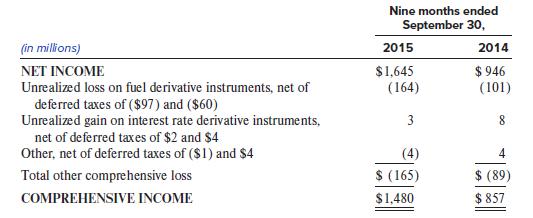

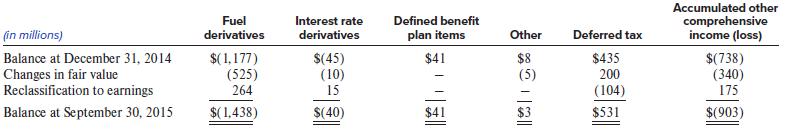

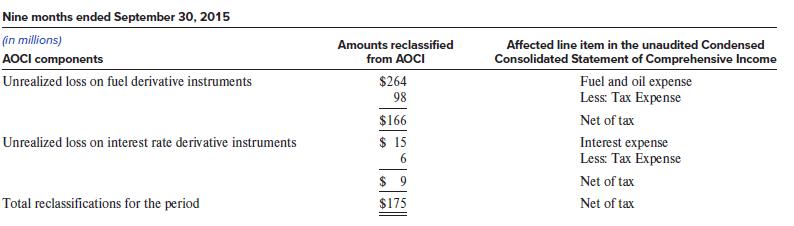

4. COMPREHENSIVE INCOME

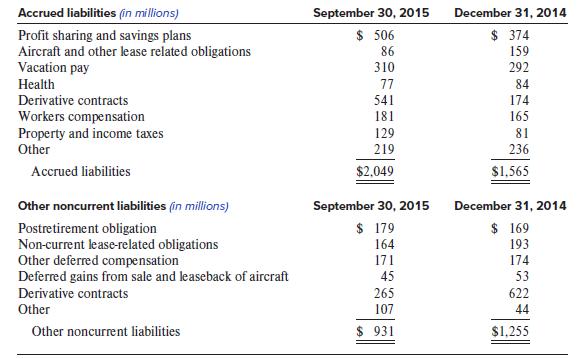

5. SUPPLEMENTAL FINANCIAL INFORMATION

Required:

1. Refer to the statements of comprehensive income for the 9 months ended September 30, 2015, and September 2014, respectively. What is the main reason that 2015 net income is higher than 2014 net income?

2. Refer to Note 3. Why might an “economic” hedge not receive hedge accounting treatment?

3. Refer to Note 3. Why do you think Southwest chose to go without fuel hedges in the fourth quarter of 2015?

4. Refer to Note 4. Other comprehensive income includes after-tax losses on fuel contracts of $164 million. Does this indicate that these are the extent of the new losses occurring in 2015?

5. How would Fuel and oil expense have changed in 2015 if Southwest had not used cash flow hedges?

6. Refer to Note 5. What does the note tell you about the timing of payments regarding derivative contracts?

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer