Which of the following represents the best investment advice? a. Avoid Texas because its expected return is

Question:

a. Avoid Texas because its expected return is lower than its required return.

b. Buy Montana and Texas because their required returns are lower than their expected returns.

c. Buy Montana because it is expected to return more than Texas, Ohio, and the market.

Janet Bellows, a portfolio manager, is attempting to explain asset valuation to a junior colleague, Bill Clay. Ms. Bellows€™s explanation focuses on the capital asset pricing model (CAPM). Of particular interest is her discussion of the security market line (SML) and its use in security selection. After a short review of the CAPM and SML, Ms. Bellows decides to test Mr. Clay€™s knowledge of valuation using the CAPM. Ms. Bellows provides the following information for Mr. Clay:

- The risk-free rate is 7 percent.

- The market risk premium during the previous year was 5.5 percent.

- The standard deviation of market returns is 35 percent.

- This year, the market risk premium is estimated to be 7 percent.

- Stock A has a beta of 1.30 and is expected to generate a 15.5 percent return.

- The correlation of stock B with the market is .88.

- The standard deviation of stock B€™s returns is 58 percent.

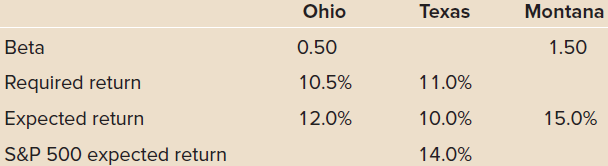

Then Ms. Bellows provides Mr. Clay with the following information about Ohio Manufacturing, Texas Energy, and Montana Mining:

The Capital Asset Pricing Model (CAPM) describes the relationship between systematic risk and expected return for assets, particularly stocks. The CAPM is a model for pricing an individual security or portfolio. For individual securities, we make use of the security market line (SML) and its... Portfolio

A portfolio is a grouping of financial assets such as stocks, bonds, commodities, currencies and cash equivalents, as well as their fund counterparts, including mutual, exchange-traded and closed funds. A portfolio can also consist of non-publicly...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Fundamentals of Investments, Valuation and Management

ISBN: 978-1259720697

8th edition

Authors: Bradford Jordan, Thomas Miller, Steve Dolvin

Question Posted: