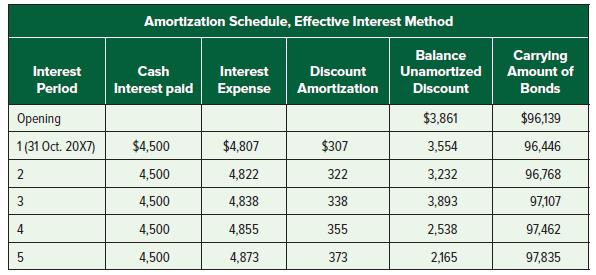

Question: The following partial amortization table has been prepared for a 9%, $100,000 5-year bond that pays interest each 30 April and 31 October. The table

The following partial amortization table has been prepared for a 9%, $100,000 5-year bond that pays interest each 30 April and 31 October. The table uses an effective interest rate of 10%. The bond was dated 1 May 20X7.

Required:

1. When the end of the fiscal period falls between bond interest payment dates, what, if anything, must be recorded at the end of the fiscal period? Must the liability balance be recalculated and included in the amortization table?

2. Prepare all entries for 20X7 and 20X8. The fiscal year ends on 31 December.

Interest Period Opening 1(31 Oct. 20X7) 2 3 4 5 Amortization Schedule, Effective Interest Method Balance Unamortized Discount $3,861 3,554 3,232 3,893 2,538 2,165 Cash Interest paid $4,500 4,500 4,500 4,500 4,500 Interest Expense $4,807 4,822 4,838 4,855 4,873 Discount Amortization $307 322 338 355 373 Carrying Amount of Bonds $96,139 96,446 96,768 97,107 97,462 97,835

Step by Step Solution

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Requirement 1 When the end of a fiscal period falls between interest payment dates it is necess... View full answer

Get step-by-step solutions from verified subject matter experts