As you are about to depart on a business trip, your accountant hands you the following information

Question:

As you are about to depart on a business trip, your accountant hands you the following information about your Thailand division.

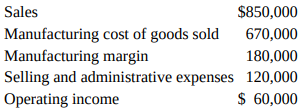

1. Master budget for the fiscal year just ended on June 30, 2010

2. Budgeted sales and production mix

Product A 50,000 units

Product B 70,000 units

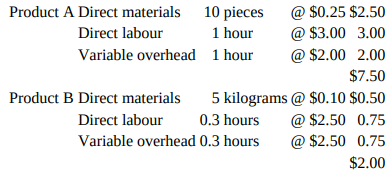

3. Standard variable manufacturing cost per unit

4. All budgeted selling and administrative expenses are common, fixed expenses; 60 percent are discretionary expenses.

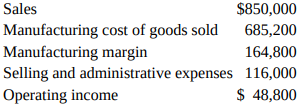

5. Actual income statement for the fiscal year ended June 30, 2010

6. Actual sales and production mix

Product A 53,000 units

Product B 64,000 units

7. Budgeted and actual sales prices

Product A $10

Product B 5

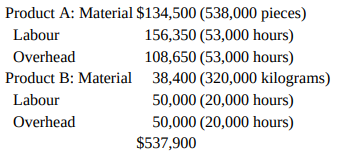

8. Schedule of the actual variable manufacturing cost of goods sold by product; actual quantities in parentheses

9. Products A and B are manufactured in separate facilities. Of the budgeted fixed manufacturing cost, $130,000 is separable as follows: $45,000 to product A and $85,000 to product B. Ten percent of these separate costs is discretionary. All other budgeted fixed manufacturing expenses, separable and common, are committed.

The purpose of your business trip is a board of directors meeting. During the meeting it is quite likely that some of the information from your accountant will be discussed. In anticipation, you set out to prepare answers to possible questions. (There is no beginning or ending inventory.)

1. Determine the firm’s budgeted break-even point in dollars, overall contribution-margin ratio, and contribution margins per unit by product.

2. Considering products A and B as segments of the firm, find the budgeted “contribution by segments" for each.

3. It is decided to allocate the budgeted selling and administrative expenses to the segments (in requirement 2) as follows: committed costs on the basis of budgeted unit sales mix and discretionary costs on the basis of actual unit sales mix. What are the final expense allocations? Briefly appraise the allocation method.

4. How would you respond to a proposal to base commissions to salespersons on the sales (revenue) value of orders received? Assume all salespersons have the opportunity to sell both products.

5. Determine the firm’s actual “contribution margin ?and “contribution controllable by segment managers" for the fiscal year ended June 30, 2010. Assume no variances in committed fixed costs.

6. Determine the “sales-volume variance" for each product for the fiscal year ended June 30, 2010.

7. Determine and identify all variances in variable manufacturing costs by product for the fiscal year ended June 30, 2010.

Contribution MarginContribution margin is an important element of cost volume profit analysis that managers carry out to assess the maximum number of units that are required to be at the breakeven point. Contribution margin is the profit before fixed cost and taxes... Ending Inventory

The ending inventory is the amount of inventory that a business is required to present on its balance sheet. It can be calculated using the ending inventory formula Ending Inventory Formula =...

Step by Step Answer:

Management Accounting

ISBN: 978-0132570848

6th Canadian edition

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu