Keyworth Co. is a large, integrated conglomerate with shipping, metals, and mining operations throughout the world. The

Question:

Keyworth Co. is a large, integrated conglomerate with shipping, metals, and mining operations throughout the world. The general manager of the Shipbuilding division plans to submit a proposed capital budget for 2011 for inclusion in the companywide budget.

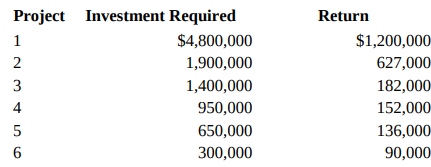

The division manager has for consideration the following projects, all of which require an outlay of capital. All projects have equal risk.

The division manager must decide which of the projects to take. The company has a cost of capital of 15 percent. An amount of $12 million is available to the division for investment purposes.

1. What will be the total investment, total return, return on capital invested, and residual income of the rational division manager if:

a. The company has a rule that all projects promising at least 20 percent or more should be taken.

b. The division manager is evaluated on his ability to maximize his return on capital invested (assume that this is a new division with no invested capital).

c. The division manager is expected to maximize residual income as computed by using the 15 percent cost of capital.

2. Which of the three approaches will induce the most effective investment policy for the company as a whole? Explain.

Cost Of CapitalCost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of...

Step by Step Answer:

Management Accounting

ISBN: 978-0132570848

6th Canadian edition

Authors: Charles T. Horngren, Gary L. Sundem, William O. Stratton, Phillip Beaulieu