You work for a firm that specializes in mergers and takeovers, and your job is to analyze

Question:

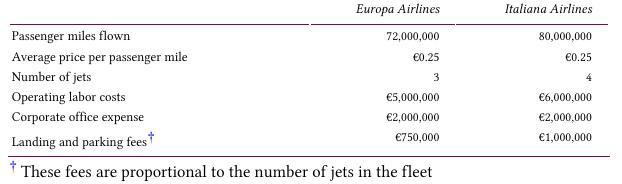

You work for a firm that specializes in mergers and takeovers, and your job is to analyze potential acquisitions. You are assigned the task to evaluate a possible merger between Europa and Italiana Airlines. These two carriers are competing in the European markets of Nice, Milan, Barcelona, and Rome. Excess capacity currently exists in these two airlines. Your boss thinks that a merger of the two airlines, accompanied by cancelling some redundant flights and raising some fares, could create the ‘synergy’ necessary to make a positive return on the acquisition. Your boss asks you to provide her with an estimate of the first-year cost savings that would result from a combination of Europa and Italiana Airlines. You assemble the following operating data on the two airlines:

Both airlines are using the same type of jet. The annual operating costs and lease payment (including fuel, maintenance, licenses, and insurance) are €3 million per jet.

After an analysis of the various markets served, you determine that a combination of the two airlines would result in the following operating characteristics: average price can be increased 10 percent, some duplicate flights can be cancelled, and combined corporate office expenses can be cut by €1 million. The combination of the higher prices and reduced frequency of flights is expected to cut demand by 6 percent. The existing flights have enough excess capacity to support a reduction in the fleet size of the combined airline by one jet.

Each firm’s operating labor costs are proportional to the number of jets in the fleet. You assume that the combined firm will have operating labor costs per jet equal to that currently being incurred by Europa. However, Italiana Airlines’ labor union contract specifies that employees with five or more years of service with the airline cannot be laid off in the event of a merger. Therefore, only some of the labor cost savings that could have been achieved by reducing the fleet to six jets will be achieved. An additional €500,000 of labor cost will be incurred as a result of the existing Italiana labor contract.

Prepare an analysis comparing the current profitability of the two airlines as independent firms, and of a combined firm using the planning assumptions stated.

Recommend a course of action, outlining other factors to consider in terms of the airlines’ strategies and operating environment.

Step by Step Answer:

Management Accounting In A Dynamic Environment

ISBN: 9780415839020

1st Edition

Authors: Cheryl S McWatters, Jerold L Zimmerman