Question: 1. Consider the following portfolio optimization problem: where is the expected return vector, is the return covariance matrix, and p is a target level of

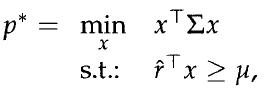

1. Consider the following portfolio optimization problem:

where ![]() is the expected return vector,

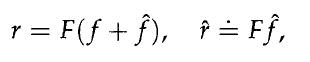

is the expected return vector, ![]() is the return covariance matrix, and p is a target level of expected portfolio return. Assume that the random return vector r follows a simplified factor model of the form

is the return covariance matrix, and p is a target level of expected portfolio return. Assume that the random return vector r follows a simplified factor model of the form

where![]() is a factor loading matrix,

is a factor loading matrix,![]() is given, and

is given, and ![]() is such that

is such that![]()

The above optimization problem is a convex quadratic problem that involves n decision variables. Explain how to cast this problem into an equivalent form that involves only k decision variables. Interpret the reduced problem geometrically. Find a closed-form solution to the problem.

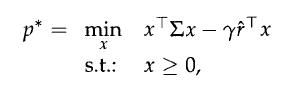

2. Consider the following variation on the previous problem:

where ![]() is a tradeoff parameter that weights the relevance in the objective of the risk term and of the return term. Due to the presence of the constraint x ≥ 0, this problem does not admit, in general, a closed-form solution.

is a tradeoff parameter that weights the relevance in the objective of the risk term and of the return term. Due to the presence of the constraint x ≥ 0, this problem does not admit, in general, a closed-form solution.

Assume that r is specified according to a factor model of the form![]() where F, / , and / are as in the previous point, and e is an idiosyncratic noise term, which is uncorrelated with

where F, / , and / are as in the previous point, and e is an idiosyncratic noise term, which is uncorrelated with ![]() and such that

and such that ![]()

Suppose we wish to solve the problem using a logarithmic barrier method of the type discussed in Section 12.3.1. Explain how to exploit the factor structure of the returns to improve the numerical performance of the algorithm.

p* = min x st: f x > ,

Step by Step Solution

3.57 Rating (168 Votes )

There are 3 Steps involved in it

Pa... View full answer

Get step-by-step solutions from verified subject matter experts