Question: We consider a single-period portfolio optimization problem with n assets. We use past samples, consisting of single-period return vectors where returns of the assets from

We consider a single-period portfolio optimization problem with n assets. We use past samples, consisting of single-period return vectors ![]() where

where ![]() returns of the assets from period t — 1 to period t. We denote by

returns of the assets from period t — 1 to period t. We denote by ![]() the vector of sample averages; it is an estimate of the expected return, based on the past samples.

the vector of sample averages; it is an estimate of the expected return, based on the past samples.

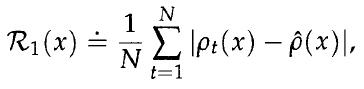

As a measure of risk, we use the following quantity. Denote by ρt{x) the return at time t (if we had held the position x at that time). Our risk measure is

where is the portfolio's sample average return.

is the portfolio's sample average return.

1. Show that![]() N matrix that you will determine. Is the risk measure R1 convex?

N matrix that you will determine. Is the risk measure R1 convex?

2. Show how to minimize the risk measure IZi, subject to the condition that the sample average of the portfolio return is greater than a target ]i, using linear programming. Make sure to put the problem in standard form, and define precisely the variables and constraints.

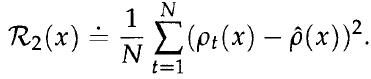

3. Comment on the qualitative difference between the resulting portfolio and one that would use the more classical, variance-based risk measure, given by

,,N,

Step by Step Solution

3.56 Rating (170 Votes )

There are 3 Steps involved in it

It seems theres a part of the question that didnt translate properly into the text format which makes it difficult to fully understand what youre asking However I will address your question based on w... View full answer

Get step-by-step solutions from verified subject matter experts