Question: 1. Consider the following portfolio optimization problem where r R n is the expected return vector, is the return covariance matrix, and is

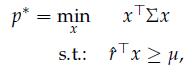

1. Consider the following portfolio optimization problem

where r̂ ∈ Rn is the expected return vector, ![]() is the return covariance matrix, and μ is a target level of expected portfolio return. Assume that the random return vector r follows a simplified factor model of the form

is the return covariance matrix, and μ is a target level of expected portfolio return. Assume that the random return vector r follows a simplified factor model of the form ![]()

where F ∈ Rn,k, k k is given, and f ∈ Rk is such that E{f} = 0 and E{f f T} = I. The above optimization problem is a convex quadratic problem that involves n decision variables. Explain how to cast this problem into an equivalent form that involves only k decision variables. Interpret the reduced problem geometrically. Find a closed-form solution to the problem.

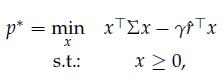

2. Consider the following variation on the previous problem where

where ![]() is a tradeoff parameters that weigths the relevance in the objective of the risk term and of the return term. Due to the presence of the constraint x ≥ 0, this problem does not admit, in general, a closed-form solution.

is a tradeoff parameters that weigths the relevance in the objective of the risk term and of the return term. Due to the presence of the constraint x ≥ 0, this problem does not admit, in general, a closed-form solution.

Assume that r is specified according to a factor model of the form![]() where F, f and f̂ are as in the previous point, and e is an idiosyncratic noise term, which is uncorrelated with

where F, f and f̂ are as in the previous point, and e is an idiosyncratic noise term, which is uncorrelated with ![]() and such that

and such that ![]() Suppose we wish to solve the problem using a logarithmic barrier method of the type discussed in Section 12.3.1. Explain how to exploit the factor structure of the returns to improve the numerical performance of the algorithm.

Suppose we wish to solve the problem using a logarithmic barrier method of the type discussed in Section 12.3.1. Explain how to exploit the factor structure of the returns to improve the numerical performance of the algorithm.

p* min X X st: PT x 2, pTx

Step by Step Solution

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Problem 1 Portfolio Optimization with Simplified Factor Model Step 1 Reformulate the Optimization Problem Given the factor model for returns r Ff hatf ... View full answer

Get step-by-step solutions from verified subject matter experts