Question: 1 points Save Answer Suppose you build an option portfolio by purchasing a call contract on Stock A with a striking price of $120 for

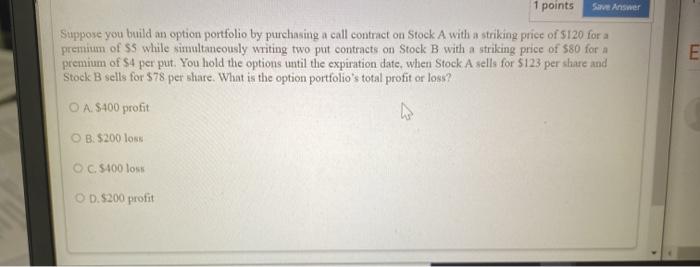

1 points Save Answer Suppose you build an option portfolio by purchasing a call contract on Stock A with a striking price of $120 for a premitum of SS while simultaneously writing two put contracts on Stock B with a striking price of 580 for a premium of S4 per put. You hold the options until the expiration date, when Stock A sells for $123 per share and Stock B sells for $78 per share. What is the option portfolio's total profit or loss? E E O A. $400 profit O B. $200 loss OC 5400 loss OD. $200 profit

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock