Question: 1: The standard deviation for assets A and B is 20% and the return for both assets is 10%. When combined in a portfolio the

1: The standard deviation for assets A and B is 20% and the return for both assets is 10%. When combined in a portfolio the new return is still 10%, but the standard deviation is not 20%. How can this be?

2: Is the average return on the market the same as the average return of all stocks in the market? (assume equal weighting)

3. Is the standard deviation of the market the same as the average standard deviation of all stocks in the market?

4. Compare your answers on questions 2/3. How is this possible?

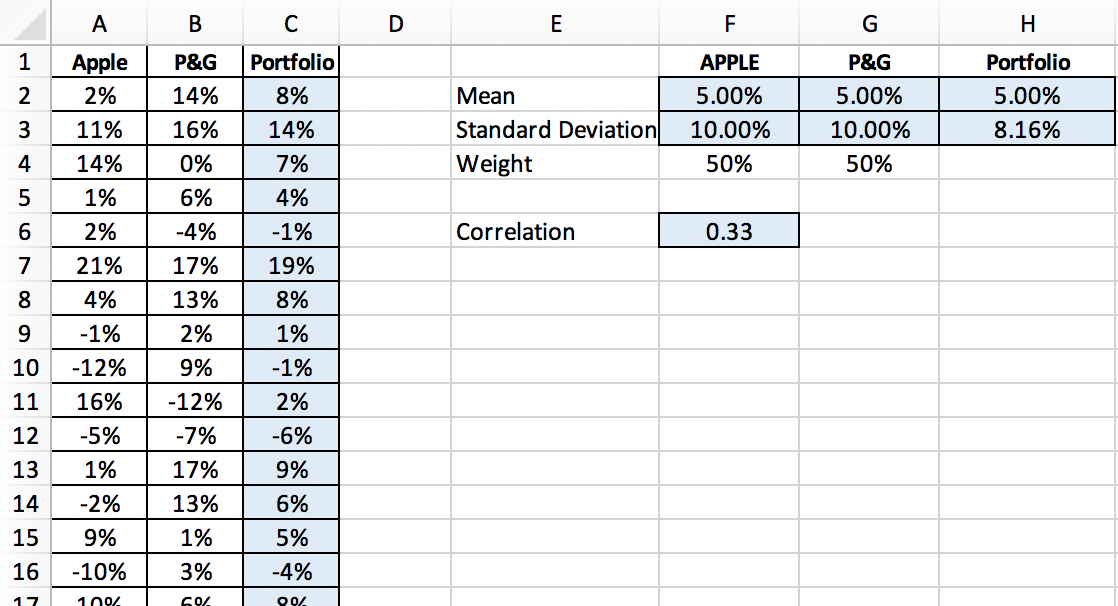

(SPREADSHEET ALREADY COMPLETED, simply including for context as needed): Fill in the missing values for the blue squares.

A B D E F G H 1 2 3 Apple 2% Portfolio 8% Mean Standard Deviation Weight APPLE 5.00% 10.00% 50% P&G 5.00% 10.00% 50% Portfolio 5.00% 8.16% 11% 14% 1% 2% P&G 14% 16% 0% 6% -4% 17% 13% 2% 9% Correlation 0.33 5 6 7 8 9 10 11 12 13 21% 4% -1% -12% 16% -5% 1% -2% 9% 14% 7% 4% -1% 19% 8% 1% -1% 2% -6% 9% 6% 5% -4% -12% -7% 17% 13% 1% 3% 14 15 16 -10% 17 100 69 po A B D E F G H 1 2 3 Apple 2% Portfolio 8% Mean Standard Deviation Weight APPLE 5.00% 10.00% 50% P&G 5.00% 10.00% 50% Portfolio 5.00% 8.16% 11% 14% 1% 2% P&G 14% 16% 0% 6% -4% 17% 13% 2% 9% Correlation 0.33 5 6 7 8 9 10 11 12 13 21% 4% -1% -12% 16% -5% 1% -2% 9% 14% 7% 4% -1% 19% 8% 1% -1% 2% -6% 9% 6% 5% -4% -12% -7% 17% 13% 1% 3% 14 15 16 -10% 17 100 69 po

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts