Question: 3. Calculating a beta coefficient for a portfolio Aa Aa Grotesque Partners is a public company, and Partners Fund is a relatively well-diversified mutual fund.

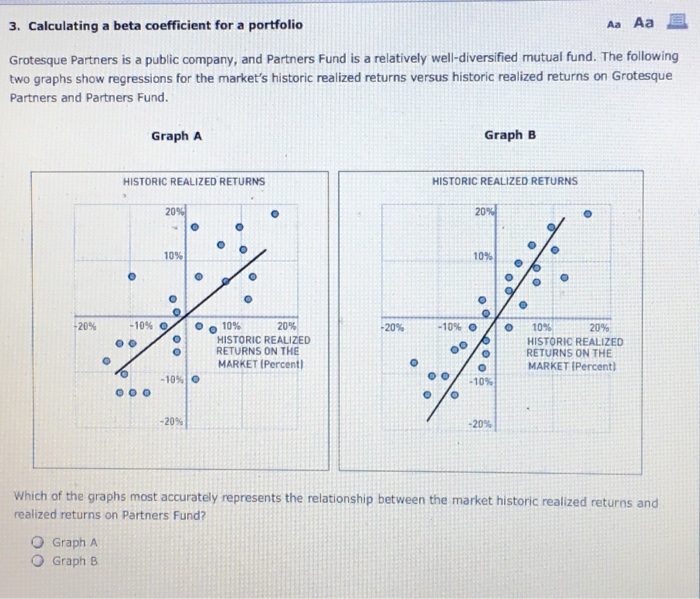

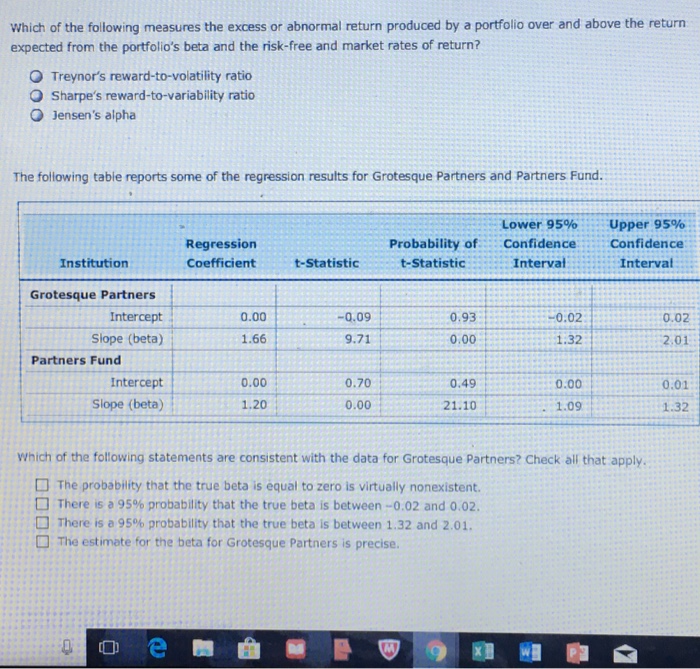

3. Calculating a beta coefficient for a portfolio Aa Aa Grotesque Partners is a public company, and Partners Fund is a relatively well-diversified mutual fund. The following two graphs show regressions for the market's historic realized returns versus historic realized returns on Grotesque Partners and Partners Fund. Graph A Graph B HISTORIC REALIZED RETURNS HISTORIC REALIZED RETURNS 20%) 20% 10% 10% -20% -10% : 0010% 20% 20% -10%0/10 10% HISTORIC REALIZED RETURNS ON THE MARKET IPercent 20% HISTORIC REALIZED RETURNS ON THE MARKET (Percent -10%) 10% -20 -20% Which of the graphs most accurately represents the relationship between the market historic realized returns and realized returns on Partners Fund? O Graph A O Graph B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts