Question: 7. Calculating a beta coefficient for a portfolio Aa Aa PietreDure Computers is a public company, and Computers Fund is a relatively well-diversified mutual fund.

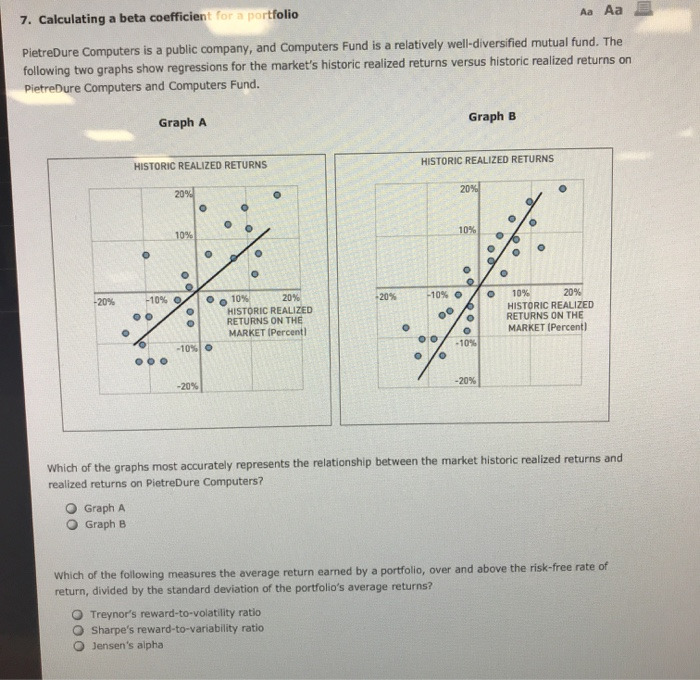

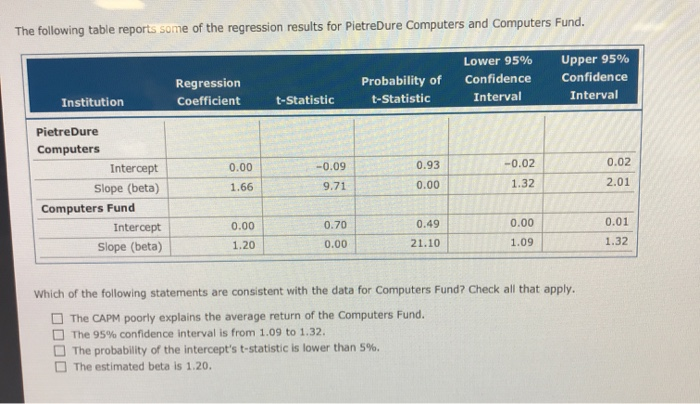

7. Calculating a beta coefficient for a portfolio Aa Aa PietreDure Computers is a public company, and Computers Fund is a relatively well-diversified mutual fund. The following two graphs show regressions for the market's historic realized returns versus historic realized returns on PietreDure Computers and Computers Fund. Graph A Graph B HISTORIC REALIZED RETURNS HISTORIC REALIZED RETURNS 2094 20% O o 10% 2012 HISTORIC REALIZED RETURNS ON THE MARKET (Percent) 10% 20% HISTORIC REALIZED RETURNS ON THE MARKET (Percent) -10% -20% -20% Which of the graphs most accurately represents the relationship between the market historic realized returns and realized returns on PietreDure Computers? Graph A Graph B Which of the following measures the average return earned by a portfolio, over and above the risk-free rate of return, divided by the standard deviation of the portfolio's average returns? O Treynor's reward-to-volatility ratio Sharpe's reward-to-variability ratio Jensen's alpha The following table reports some of the regression results for PietreDure Computers and Computers Fund. Regression Coefficient Probability of t-Statistic Lower 95% Confidence Interval Upper 95% Confidence Interval Institution t-Statistic 0.00 -0.02 Pietre Dure Computers Intercept Slope (beta) Computers Fund Intercept Slope (beta) -0.09 9.71 0.93 0.00 0.02 2.01 1.66 1.32 0.00 0.00 1.20 0.70 0.00 0.49 21.10 0.01 1.32 1.09 Which of the following statements are consistent with the data for Computers Fund? Check all that apply. The CAPM poorly explains the average return of the Computers Fund. The 95% confidence interval is from 1.09 to 1.32 The probability of the intercept's t-statistic is lower than 5%. The estimated beta is 1.20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts