Question: 4. a. Find the standard deviation (o) for the 60 monthly realized returns. Use the standard deviation function to do this. b. Translate this number

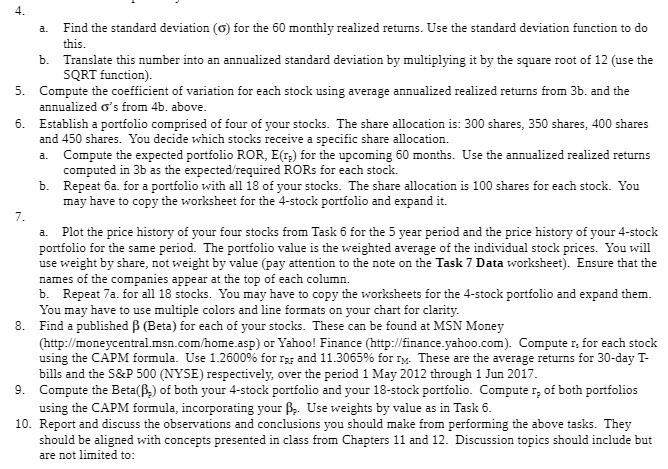

4. a. Find the standard deviation (o) for the 60 monthly realized returns. Use the standard deviation function to do this. b. Translate this number into an annualized standard deviation by multiplying it by the square root of 12 (use the SQRT function). 5. Compute the coefficient of variation for each stock using average annualized realized returns from 3b. and the annualized o's from 4b. above. 6. Establish a portfolio comprised of four of your stocks. The share allocation is: 300 shares, 350 shares, 400 shares and 450 shares. You decide which stocks receive a specific share allocation. a. Compute the expected portfolio ROR, E(r,) for the upcoming 60 months. Use the annualized realized returns computed in 3b as the expected/required RORs for each stock. b. Repeat 6a. for a portfolio with all 18 of your stocks. The share allocation is 100 shares for each stock. You may have to copy the worksheet for the 4-stock portfolio and expand it. 7. a. Plot the price history of your four stocks from Task 6 for the 5 year period and the price history of your 4-stock portfolio for the same period. The portfolio value is the weighted average of the individual stock prices. You will use weight by share, not weight by value (pay attention to the note on the Task 7 Data worksheet). Ensure that the names of the companies appear at the top of each column. b. Repeat 7a. for all 18 stocks. You may have to copy the worksheets for the 4-stock portfolio and expand them. You may have to use multiple colors and line formats on your chart for clarity. 8. Find a published B (Beta) for each of your stocks. These can be found at MSN Money (http://moneycentral.man.com/home.asp) or Yahoo! Finance (http://finance.yahoo.com). Computer, for each stock using the CAPM formula. Use 1.2600% for rap and 11.3065% for ry. These are the average returns for 30-day T- bills and the 5&P 500 (NYSE) respectively, over the period 1 May 2012 through 1 Jun 2017. 9. Compute the Beta(B,) of both your 4-stock portfolio and your 18-stock portfolio. Computer, of both portfolios using the CAPM formula, incorporating your B;. Use weights by value as in Task 6. 10. Report and discuss the observations and conclusions you should make from performing the above tasks. They should be aligned with concepts presented in class from Chapters 11 and 12. Discussion topics should include but are not limited to

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts