Question: 6. (total 3 points) Consider two stocks A and B, with monthly (simple) returns rA and rb. Assume that the expected monthly returns of the

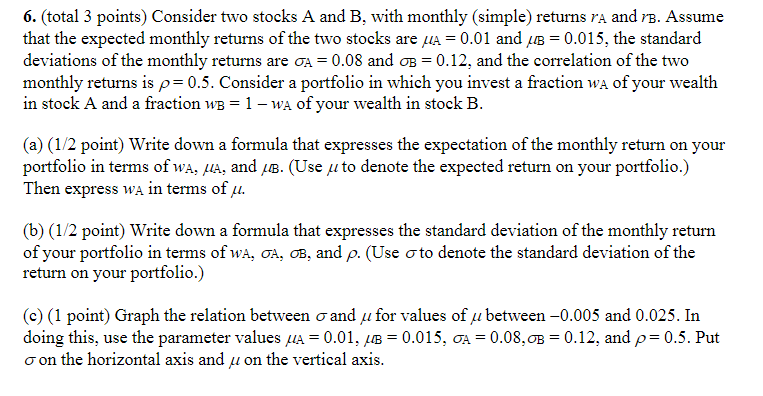

6. (total 3 points) Consider two stocks A and B, with monthly (simple) returns rA and rb. Assume that the expected monthly returns of the two stocks are up = 0.01 and JB = 0.015, the standard deviations of the monthly returns are CA = 0.08 and B = 0.12, and the correlation of the two monthly returns is p=0.5. Consider a portfolio in which you invest a fraction WA of your wealth in stock A and a fraction wB = 1 WA of your wealth in stock B. (a) (1/2 point) Write down a formula that expresses the expectation of the monthly return on your portfolio in terms of wA, MA, and LB. (Use u to denote the expected return on your portfolio.) Then express wa in terms of u. (b)(1/2 point) Write down a formula that expresses the standard deviation of the monthly return of your portfolio in terms of wA, OA, B, and p. (Use o to denote the standard deviation of the return on your portfolio.) () (1 point) Graph the relation between o and u for values of u between -0.005 and 0.025. In doing this, use the parameter values MA = 0.01, LB = 0.015, CA = 0.08.0B =0.12, and p=0.5. Put o on the horizontal axis and u on the vertical axis. 6. (total 3 points) Consider two stocks A and B, with monthly (simple) returns rA and rb. Assume that the expected monthly returns of the two stocks are up = 0.01 and JB = 0.015, the standard deviations of the monthly returns are CA = 0.08 and B = 0.12, and the correlation of the two monthly returns is p=0.5. Consider a portfolio in which you invest a fraction WA of your wealth in stock A and a fraction wB = 1 WA of your wealth in stock B. (a) (1/2 point) Write down a formula that expresses the expectation of the monthly return on your portfolio in terms of wA, MA, and LB. (Use u to denote the expected return on your portfolio.) Then express wa in terms of u. (b)(1/2 point) Write down a formula that expresses the standard deviation of the monthly return of your portfolio in terms of wA, OA, B, and p. (Use o to denote the standard deviation of the return on your portfolio.) () (1 point) Graph the relation between o and u for values of u between -0.005 and 0.025. In doing this, use the parameter values MA = 0.01, LB = 0.015, CA = 0.08.0B =0.12, and p=0.5. Put o on the horizontal axis and u on the vertical axis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts