Question: Answer these quickly and correctly for automatic thumbs up! Thanks so much! The risk free rate is 6% and the market risk premium is 5%

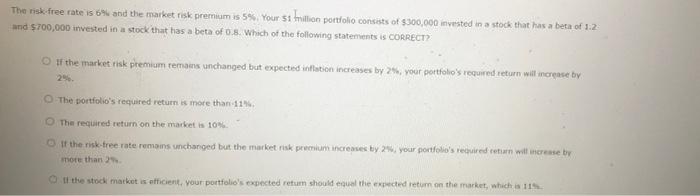

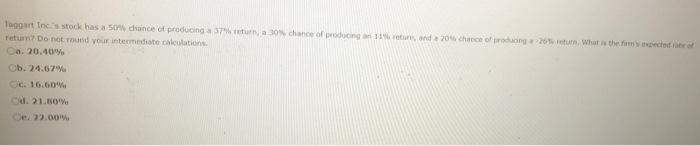

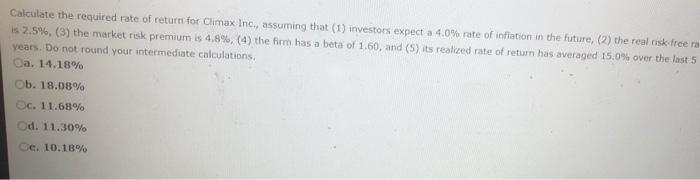

The risk free rate is 6% and the market risk premium is 5% Your St Frillion portfolio consists of $300,000 invested in a stock that has a beta of 1.2 and $700,000 invested in a stock that has a beta of 0.8. Which of the following statements is CORRECT If the market risk premium remains unchanged but expected inflation increases by 2 your portfolio's required return will increase by 29. The portfolio's required return is more than 11 The required return on the market is 10% If the risk-tree rate remains unchanged but the market risk premium increases by 2 your portfolio's required return will increase by more than tl the stock market is officient, your portfolio's expected return should equal the expected return on the market, which is 11 Taggart Inc.'s stock has a so chance of producing a 37%, a on chance of producing 11. vetus, and 20% chce of reducing 26.tum, What is the nexpected retu Do not round your intermediate calculations Ca. 20.40% Cb. 24.67% c. 16.60 Cd. 21.10. Calculate the required rate of return for Climax Inc., assuming that (1) investors expect a 4.0% rate of inflation in the future, (2) the real riskfreera is 2.5%, (3) the market risk premium is 4.8%, (4) the firm has a beta of 1.60, and (5) its realized rate of return has averaged 15.0% over the last 5 years. Do not round your intermediate calculations, Ca. 14.18% Ob. 18.08% c. 11.68% Od. 11.30% De 10.18%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts