Question: applying Activity Based Cost (ABC) Allocation Methods to Customer Profitability Analysis Indirect costs Bountiful Harvest Distribution delivers supplies to small grocers throughout the region. Bountiful

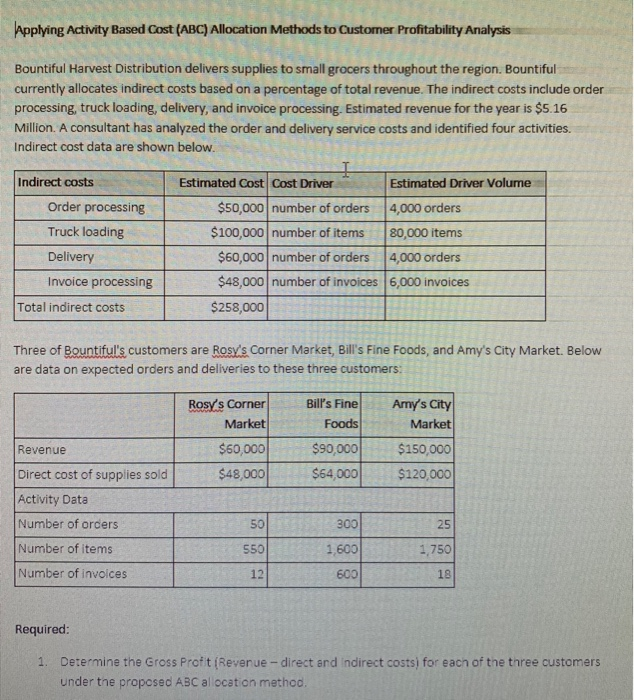

applying Activity Based Cost (ABC) Allocation Methods to Customer Profitability Analysis Indirect costs Bountiful Harvest Distribution delivers supplies to small grocers throughout the region. Bountiful currently allocates indirect costs based on a percentage of total revenue. The indirect costs include order processing, truck loading, delivery, and invoice processing. Estimated revenue for the year is $5.16 Million. A consultant has analyzed the order and delivery service costs and identified four activities. Indirect cost data are shown below. 1 Estimated Cost Cost Driver Estimated Driver Volume Order processing $50,000 number of orders 4,000 orders ruck loading $100,000 number of items 80,000 items Delivery $60,000 number of orders 4,000 orders Invoice processing $48,000 number of invoices 6,000 invoices Total indirect costs $258,000 Three of Bountiful's customers are Rosy's Corner Market, Bill's Fine Foods, and Amy's City Market. Below are data on expected orders and deliveries to these three customers: Rosy's Corner Market Bill's Fine Foods Amy's City Market $150,000 $120,000 Revenue $60,000 $48,000 $90,000 $64,000 Direct cost of supplies sold Activity Data Number of orders 50 300 25 Number of items 550 1,600 1,750 Number of invoices 12 600 18 Required: 1 Determine the Gross Profit (Revenue - direct and indirect costs for each of the three customers under the proposed ABC allocation method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts