Question: Applying Traditional Cost Allocation Methods to Customer Profitability Analysis Bountiful Harvest Distribution delivers supplies to small grocers throughout the region. Bountiful currently allocates indirect costs

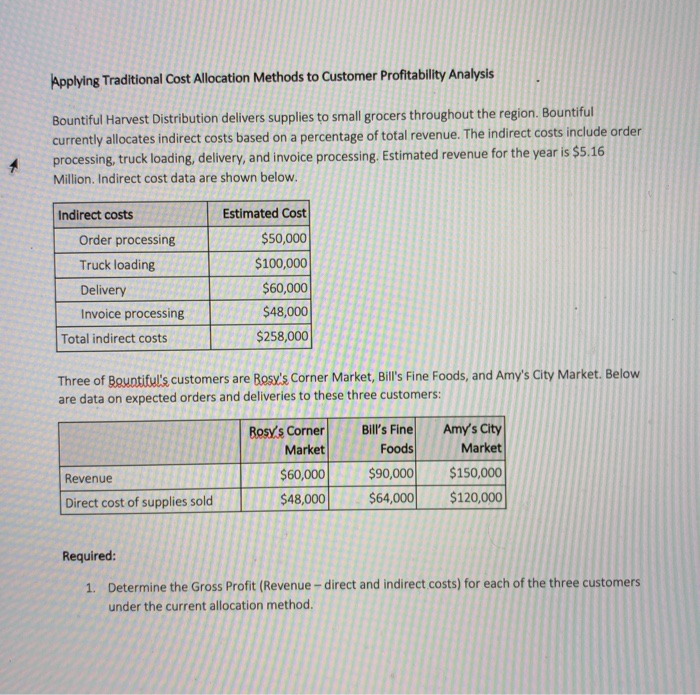

Applying Traditional Cost Allocation Methods to Customer Profitability Analysis Bountiful Harvest Distribution delivers supplies to small grocers throughout the region. Bountiful currently allocates indirect costs based on a percentage of total revenue. The indirect costs include order processing, truck loading, delivery, and invoice processing. Estimated revenue for the year is $5.16 Million. Indirect cost data are shown below. 4 Indirect costs Order processing Truck loading Delivery Invoice processing Total indirect costs Estimated cost $50,000 $100,000 $60,000 $48,000 $258,000 Three of Bountiful's customers are Besy's Corner Market, Bill's Fine Foods, and Amy's City Market. Below are data on expected orders and deliveries to these three customers: Rosy's Corner Market $60,000 $48,000 Bill's Fine Foods $90,000 $64,000 Amy's City Market $150,000 $120,000 Revenue Direct cost of supplies sold Required: 1. Determine the Gross Profit (Revenue - direct and indirect costs) for each of the three customers under the current allocation method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts