Question: Applying Activity Based Cost (ABC) Allocation Methods to Customer Profitability Analysis Bountiful Harvest Distribution delivers supplies to small grocers throughout the region. Bountiful currently allocates

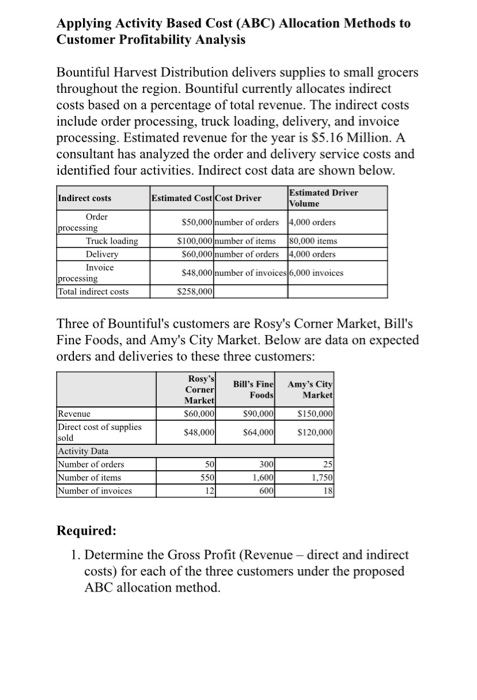

Applying Activity Based Cost (ABC) Allocation Methods to Customer Profitability Analysis Bountiful Harvest Distribution delivers supplies to small grocers throughout the region. Bountiful currently allocates indirect costs based on a percentage of total revenue. The indirect costs include order processing, truck loading, delivery, and invoice processing. Estimated revenue for the year is $5.16 Million. A consultant has analyzed the order and delivery service costs and identified four activities. Indirect cost data are shown below. Estimated Driver Indirect costs Estimated Cost Cost Driver Volume Order processing Truck loading Delivery Invoice processing Total indirect costs $50,000 number of orders 4.000 orders $100,000 number of items 80.000 items $60,000 number of orders 4.000 orders $48,000 number of invoices 6,000 invoices S258,000 Three of Bountiful's customers are Rosy's Corner Market, Bill's Fine Foods, and Amy's City Market. Below are data on expected orders and deliveries to these three customers: Resy's Corner Bill's Fine Foods Market $60,000 Amy's City Market S150,000 $120,000 $90,000 $48,000 S64,000 Revenue Direct cost of supplies sold Activity Data Number of orders Number of items Number of invoices 50 550 12 300 1.600 600 25 1.750 18 Required: 1. Determine the Gross Profit (Revenue - direct and indirect costs) for each of the three customers under the proposed ABC allocation method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts