Question: b. Plot (1) the holding-period returns for Wal-Mart against the Standard & Poors 500 Index, and (2) the Target holding-period returns against the Standard &

b. Plot (1) the holding-period returns for Wal-Mart against the Standard & Poors 500 Index, and (2) the Target holding-period returns against the Standard & Poors 500 Index. From your graphs, describe the nature of the relationship between stock returns for Wal-Mart and the returns for the S&P 500 Index. Make the same comparison for Target.

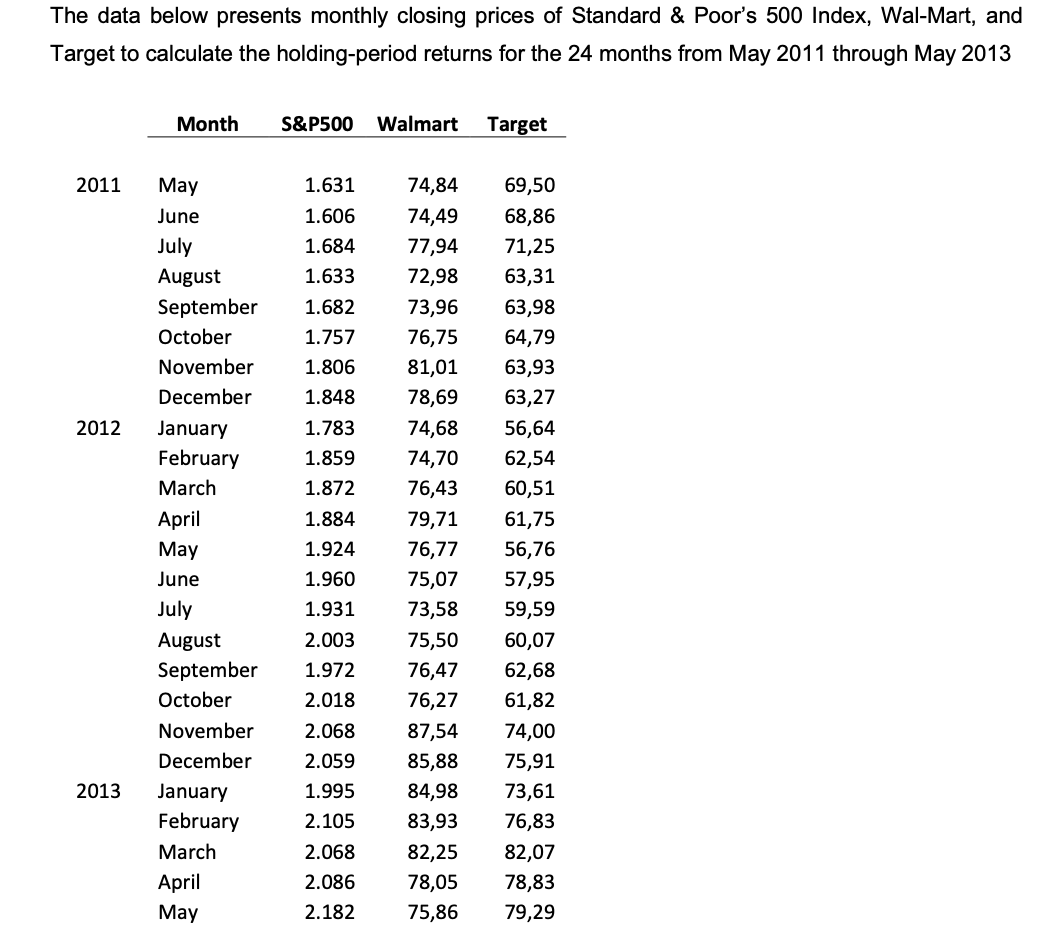

The data below presents monthly closing prices of Standard & Poor's 500 Index, Wal-Mart, and Target to calculate the holding-period returns for the 24 months from May 2011 through May 2013 Month S&P500 Walmart Target 2011 1.631 2012 May June July August September October November December January February March April May June July August September October November December January February March April May 1.606 1.684 1.633 1.682 1.757 1.806 1.848 1.783 1.859 1.872 1.884 1.924 1.960 1.931 2.003 1.972 2.018 2.068 2.059 1.995 2.105 2.068 2.086 2.182 74,84 74,49 77,94 72,98 73,96 76,75 81,01 78,69 74,68 74,70 76,43 79,71 76,77 75,07 73,58 75,50 76,47 76,27 87,54 85,88 84,98 83,93 82,25 78,05 75,86 69,50 68,86 71,25 63,31 63,98 64,79 63,93 63,27 56,64 62,54 60,51 61,75 56,76 57,95 59,59 60,07 62,68 61,82 74,00 75,91 73,61 76,83 82,07 78,83 79,29 2013 The data below presents monthly closing prices of Standard & Poor's 500 Index, Wal-Mart, and Target to calculate the holding-period returns for the 24 months from May 2011 through May 2013 Month S&P500 Walmart Target 2011 1.631 2012 May June July August September October November December January February March April May June July August September October November December January February March April May 1.606 1.684 1.633 1.682 1.757 1.806 1.848 1.783 1.859 1.872 1.884 1.924 1.960 1.931 2.003 1.972 2.018 2.068 2.059 1.995 2.105 2.068 2.086 2.182 74,84 74,49 77,94 72,98 73,96 76,75 81,01 78,69 74,68 74,70 76,43 79,71 76,77 75,07 73,58 75,50 76,47 76,27 87,54 85,88 84,98 83,93 82,25 78,05 75,86 69,50 68,86 71,25 63,31 63,98 64,79 63,93 63,27 56,64 62,54 60,51 61,75 56,76 57,95 59,59 60,07 62,68 61,82 74,00 75,91 73,61 76,83 82,07 78,83 79,29 2013

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts