Question: By what amounts are the financial statements wrong before the corrections are made for the forgotten transaction? Ignore any tax effects. A firm neglected to

By what amounts are the financial statements wrong before the corrections are made for the forgotten transaction? Ignore any tax effects.

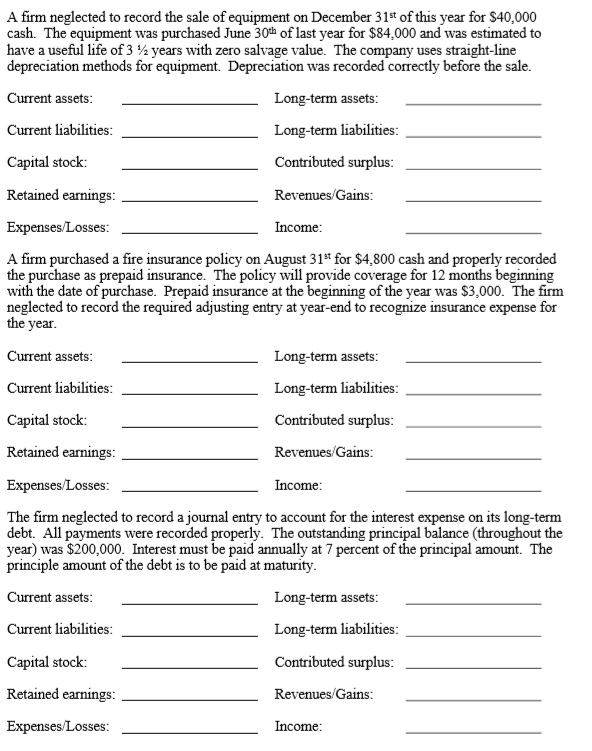

A firm neglected to record the sale of equipment on December 31st of this year for $40,000 cash. The equipment was purchased June 30th of last year for $84,000 and was estimated to have a useful life of 3 %2 years with zero salvage value. The company uses straight-line depreciation methods for equipment. Depreciation was recorded correctly before the sale. Current assets: Long-term assets: Current liabilities: Long-term liabilities: Capital stock: Contributed surplus: Retained earnings: Revenues/Gains: Expenses/Losses: Income: A firm purchased a fire insurance policy on August 31** for $4,800 cash and properly recorded the purchase as prepaid insurance. The policy will provide coverage for 12 months beginning with the date of purchase. Prepaid insurance at the beginning of the year was $3,000. The firm neglected to record the required adjusting entry at year-end to recognize insurance expense for the year. Current assets: Long-term assets: Current liabilities: Long-term liabilities: Capital stock: Contributed surplus: Retained earnings: Revenues/Gains: Expenses/Losses: Income: The firm neglected to record a journal entry to account for the interest expense on its long-term debt. All payments were recorded properly. The outstanding principal balance (throughout the year) was $200,000. Interest must be paid annually at 7 percent of the principal amount. The principle amount of the debt is to be paid at maturity. Current assets: Long-term assets: Current liabilities: Long-term liabilities: Capital stock: Contributed surplus: Retained earnings: Revenues/Gains: Expenses/Losses: Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts