Question: By what amounts are the financial statements wrong before the corrections are made for the forgotten transaction? Ignore any tax effects. A firm neglected to

By what amounts are the financial statements wrong before the corrections are made for the forgotten transaction? Ignore any tax effects.

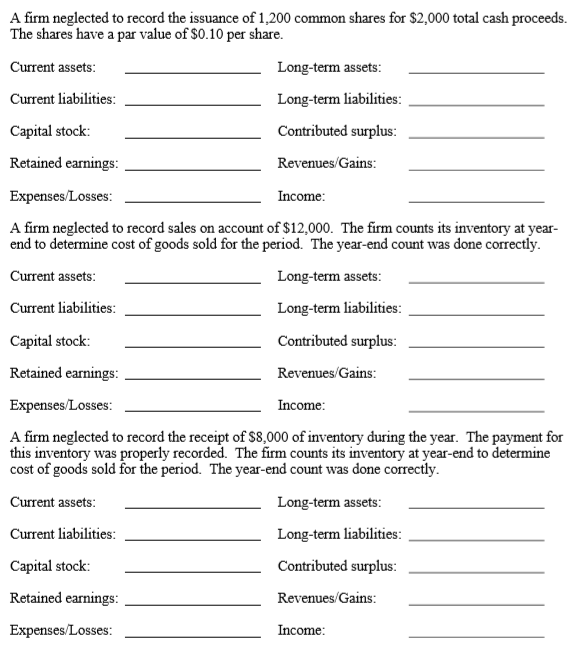

A firm neglected to record the issuance of 1,200 common shares for $2,000 total cash proceeds. The shares have a par value of $0.10 per share. Current assets: Long-term assets: Current liabilities: Long-term liabilities: Capital stock: Contributed surplus: Retained earnings: Revenues/Gains: Expenses/Losses: Income: A firm neglected to record sales on account of $12,000. The firm counts its inventory at year- end to determine cost of goods sold for the period. The year-end count was done correctly. Current assets: Long-term assets: Current liabilities: Long-term liabilities: Capital stock Contributed surplus: Retained earnings: Revenues/Gains: Expenses/Losses: Income: A firm neglected to record the receipt of $8,000 of inventory during the year. The payment for this inventory was properly recorded. The firm counts its inventory at year-end to determine cost of goods sold for the period. The year-end count was done correctly. Current assets: Long-term assets: Current liabilities: Long-term liabilities: Capital stock: Contributed surplus: Retained earnings: Revenues/Gains: Expenses/Losses: Income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts