Question: case study article: rubric: Case 1.1 The Valley Winery* Pat Waller, recently hired as sales manager of the San Francisco region's chain division, was lamenting

case study article:

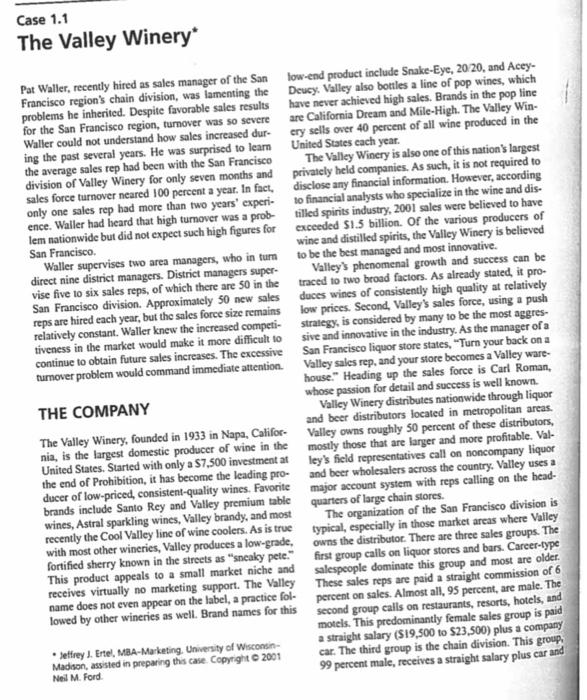

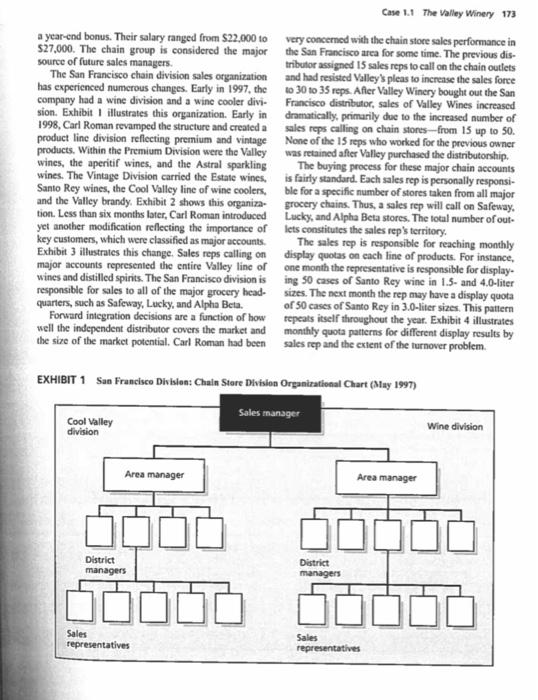

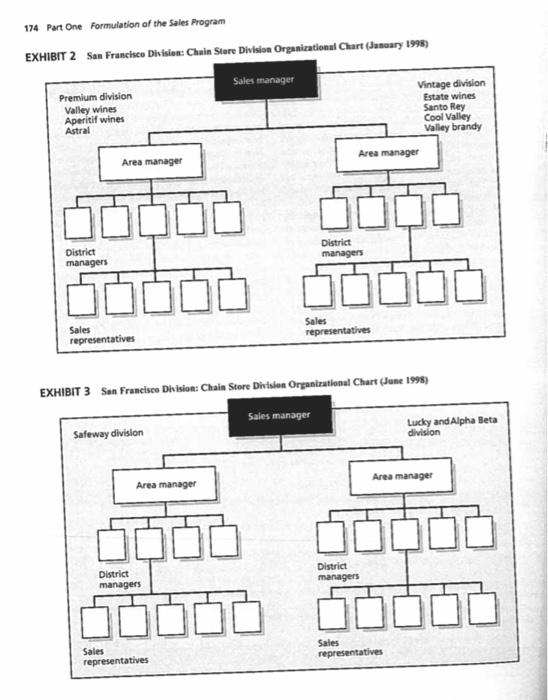

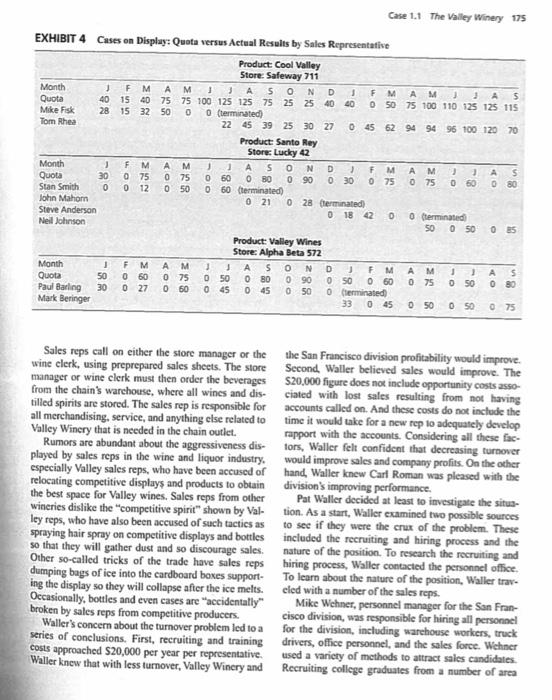

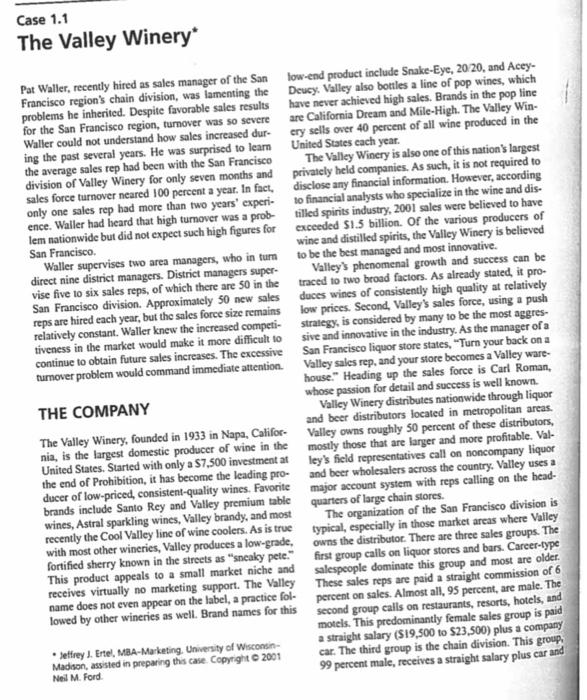

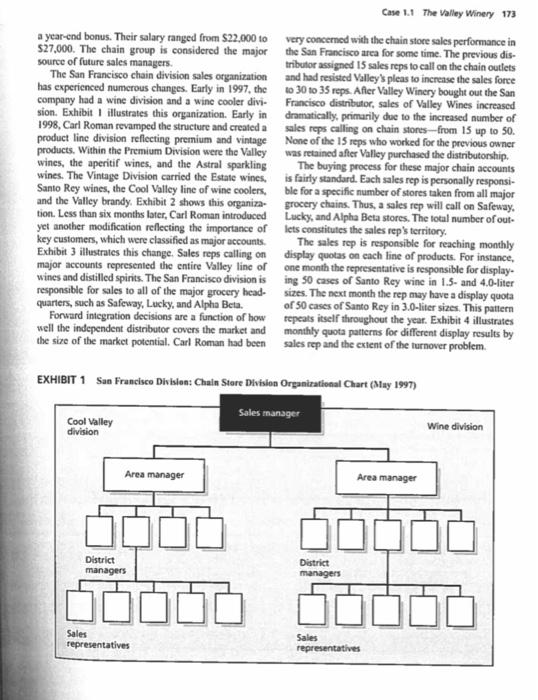

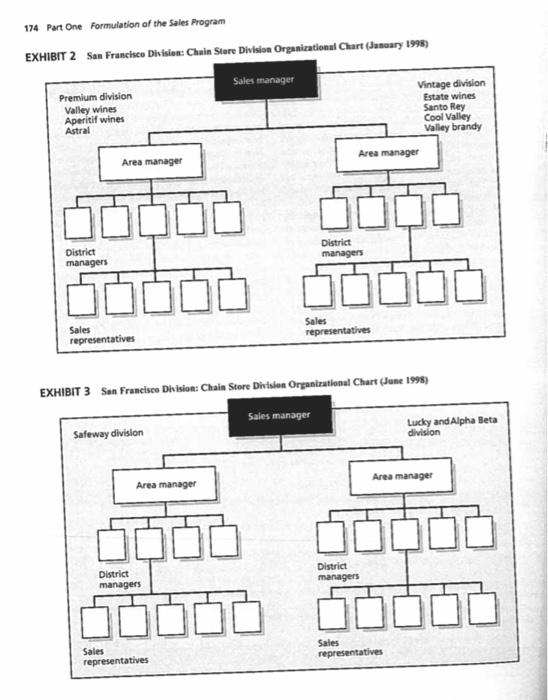

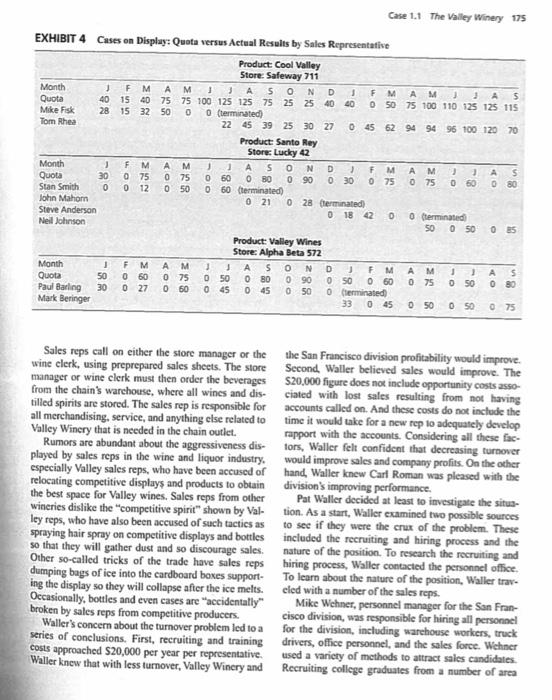

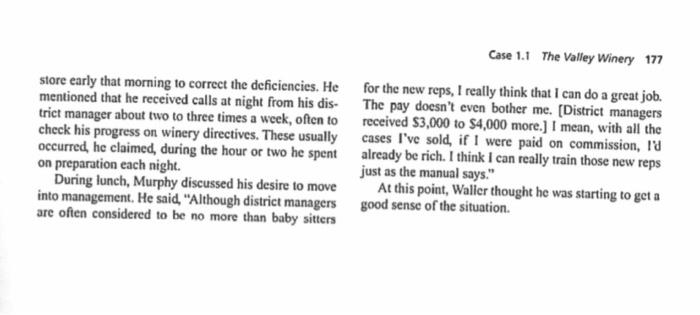

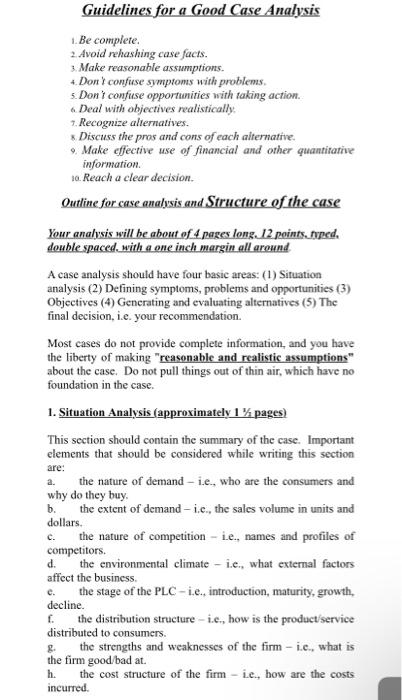

Case 1.1 The Valley Winery* Pat Waller, recently hired as sales manager of the San Francisco region's chain division, was lamenting the problems he inherited. Despite favorable sales results for the San Francisco region, turnover was so severe Waller could not understand how sales increased dur- ing the past several years. He was surprised to learn the average sales rep had been with the San Francisco division of Valley Winery for only seven months and sales force turnover neared 100 percent a year. In fact, only one sales rep had more than two years' experi- ence. Waller had heard that high turnover was a prob- lem nationwide but did not expect such high figures for San Francisco. Waller supervises two area managers, who in turn direct nine district managers. District managers super- vise five to six sales reps, of which there are 50 in the San Francisco division. Approximately 50 new sales reps are hired each year, but the sales force size remains relatively constant. Waller knew the increased competi- tiveness in the market would make it more difficult to continue to obtain future sales increases. The excessive turnover problem would command immediate attention. THE COMPANY The Valley Winery, founded in 1933 in Napa, Califor- nia, is the largest domestic producer of wine in the United States. Started with only a $7,500 investment at the end of Prohibition, it has become the leading pro- ducer of low-priced, consistent-quality wines. Favorite brands include Santo Rey and Valley premium table wines, Astral sparkling wines, Valley brandy, and most recently the Cool Valley line of wine coolers. As is true with most other wineries, Valley produces a low-grade, fortified sherry known in the streets as "sneaky pete." This product appeals to a small market niche and receives virtually no marketing support. The Valley name does not even appear on the label, a practice fol- lowed by other wineries as well. Brand names for this Jeffrey J. Ertel, MBA-Marketing, University of Wisconsin- Madison, assisted in preparing this case. Copyright 2001 Neil M. Ford low-end product include Snake-Eye, 20/20, and Acey- Deucy Valley also bottles a line of pop wines, which have never achieved high sales. Brands in the pop line are California Dream and Mile-High. The Valley Win- ery sells over 40 percent of all wine produced in the United States each year. The Valley Winery is also one of this nation's largest privately held companies. As such, it is not required to disclose any financial information. However, according to financial analysts who specialize in the wine and dis- tilled spirits industry, 2001 sales were believed to have exceeded $1.5 billion. Of the various producers of wine and distilled spirits, the Valley Winery is believed to be the best managed and most innovative. Valley's phenomenal growth and success can be traced to two broad factors. As already stated, it pro- duces wines of consistently high quality at relatively low prices. Second, Valley's sales force, using a push strategy, is considered by many to be the most aggres- sive and innovative in the industry. As the manager of a San Francisco liquor store states, "Turn your back on a Valley sales rep, and your store becomes a Valley ware- house." Heading up the sales force is Carl Roman, whose passion for detail and success is well known. Valley Winery distributes nationwide through liquor and beer distributors located in metropolitan areas. Valley owns roughly 50 percent of these distributors, mostly those that are larger and more profitable. Val- ley's field representatives call on noncompany liquor and beer wholesalers across the country. Valley uses a major account system with reps calling on the head- quarters of large chain stores. The organization of the San Francisco division is typical, especially in those market areas where Valley owns the distributor. There are three sales groups. The first group calls on liquor stores and bars. Career-type salespeople dominate this group and most are older. These sales reps are paid a straight commission of 6 percent on sales. Almost all, 95 percent, are male. The second group calls on restaurants, resorts, hotels, and motels. This predominantly female sales group is paid a straight salary ($19,500 to $23,500) plus a company car. The third group is the chain division. This group, 99 percent male, receives a straight salary plus car and Case 1.1 The Valley Winery 173 very concerned with the chain store sales performance in the San Francisco area for some time. The previous dis- tributor assigned 15 sales reps to call on the chain outlets and had resisted Valley's pleas to increase the sales force to 30 to 35 reps. After Valley Winery bought out the San Francisco distributor, sales of Valley Wines increased dramatically, primarily due to the increased number of sales reps calling on chain stores-from 15 up to 50. None of the 15 reps who worked for the previous owner was retained after Valley purchased the distributorship. The buying process for these major chain accounts is fairly standard. Each sales rep is personally responsi- ble for a specific number of stores taken from all major grocery chains. Thus, a sales rep will call on Safeway, Lucky, and Alpha Beta stores. The total number of out- lets constitutes the sales rep's territory. The sales rep is responsible for reaching monthly display quotas on each line of products. For instance, one month the representative is responsible for display- ing 50 cases of Santo Rey wine in 1.5- and 4.0-liter sizes. The next month the rep may have a display quota of 50 cases of Santo Rey in 3.0-liter sizes. This pattern repeats itself throughout the year. Exhibit 4 illustrates monthly quota patterns for different display results by sales rep and the extent of the turnover problem. Wine division a year-end bonus. Their salary ranged from $22,000 to $27,000. The chain group is considered the major source of future sales managers. The San Francisco chain division sales organization has experienced numerous changes. Early in 1997, the company had a wine division and a wine cooler divi- sion. Exhibit 1 illustrates this organization. Early in 1998, Carl Roman revamped the structure and created a product line division reflecting premium and vintage products. Within the Premium Division were the Valley wines, the aperitif wines, and the Astral sparkling wines. The Vintage Division carried the Estate wines, Santo Rey wines, the Cool Valley line of wine coolers, and the Valley brandy. Exhibit 2 shows this organiza- tion. Less than six months later, Carl Roman introduced yet another modification reflecting the importance of key customers, which were classified as major accounts. Exhibit 3 illustrates this change. Sales reps calling on major accounts represented the entire Valley line of wines and distilled spirits. The San Francisco division is responsible for sales to all of the major grocery head- quarters, such as Safeway, Lucky, and Alpha Beta. Forward integration decisions are a function of how well the independent distributor covers the market and the size of the market potential. Carl Roman had been EXHIBIT 1 San Francisco Division: Chain Store Division Organizational Chart (May 1997) Sales manager Cool Valley division Area manager Area manager District managers Sales representatives District managers Sales representatives 174 Part One Formulation of the Sales Program EXHIBIT 2 San Francisco Division: Chain Store Division Organizational Chart (January 1998) Sales manager Premium division Valley wines Aperitif wines Astral Area manager Area manager 60000 Vintage division Estate wines Santo Rey Cool Valley Valley brandy District managers District managers 10 Sales representatives Sales representatives EXHIBIT 3 San Francisco Division: Chain Store Division Organizational Chart (June 1998) Sales manager Safeway division Area manager District managers 60000 10 Sales representatives District managers Sales representatives Lucky and Alpha Beta division Area manager Case 1.1 The Valley Winery 175 EXHIBIT 4 Cases on Display: Quota versus Actual Results by Sales Representative Product: Cool Valley Store: Safeway 711 J F M A 1 F M 3 AS Month Quota 40 J 3 A S ON D 100 125 125 75 25 25 40 40 0 (terminated) A M J 75 100 110 125 125 115 40 15 28 15 32 0 50 Mike Fisk 0 Tom Rhea 0 45 62 94 94 96 100 120 70 22 45 39 25 30 27 Product: Santo Rey Store: Lucky 42 Month F M A M 1 A N D 0 30 F J M 0 75 A M 075 Quota 075 J 3 060 A S 080 075 090 Stan Smith 0 12 0 50 John Mahom 0 21 0 28 (terminated) 018 42 0 Steve Anderson Neil Johnson 0 (terminated) 50 0 500 85 Product: Valley Wines Store: Alpha Beta 572 Month A S J M S M A 0 60 0 27 AM 1 J 0.75 Quota A 0 80 0 50 Paul Barling Mark Beringer 0 50 60 0 (terminated) 0 45 045 33 0:45 0 50 050 0.75 Sales reps call on either the store manager or the wine clerk, using preprepared sales sheets. The store manager or wine clerk must then order the beverages from the chain's warehouse, where all wines and dis- tilled spirits are stored. The sales rep is responsible for all merchandising, service, and anything else related to Valley Winery that is needed in the chain outlet. the San Francisco division profitability would improve. Second, Waller believed sales would improve. The $20,000 figure does not include opportunity costs asso- ciated with lost sales resulting from not having accounts called on. And these costs do not include the time it would take for a new rep to adequately develop rapport with the accounts. Considering all these fac- tors, Waller felt confident that decreasing turnover would improve sales and company profits. On the other hand, Waller knew Carl Roman was pleased with the division's improving performance. Rumors are abundant about the aggressiveness dis- played by sales reps in the wine and liquor industry. especially Valley sales reps, who have been accused of relocating competitive displays and products to obtain the best space for Valley wines. Sales reps from other wineries dislike the "competitive spirit" shown by Val- ley reps, who have also been accused of such tactics as spraying hair spray on competitive displays and bottles so that they will gather dust and so discourage sales. Other so-called tricks of the trade have sales reps dumping bags of ice into the cardboard boxes support- ing the display so they will collapse after the ice melts. Occasionally, bottles and even cases are "accidentally" broken by sales reps from competitive producers. Pat Waller decided at least to investigate the situa- tion. As a start, Waller examined two possible sources to see if they were the crux of the problem. These included the recruiting and hiring process and the nature of the position. To research the recruiting and hiring process, Waller contacted the personnel office. To learn about the nature of the position, Waller trav- eled with a number of the sales reps. Waller's concern about the turnover problem led to a series of conclusions. First, recruiting and training costs approached $20,000 per year per representative. Waller knew that with less turnover, Valley Winery and Mike Wehner, personnel manager for the San Fran- cisco division, was responsible for hiring all personnel for the division, including warehouse workers, truck drivers, office personnel, and the sales force. Wehner used a variety of methods to attract sales candidates. Recruiting college graduates from a number of area 8. 080 30 J 50 30 FOO 5 MSO 400 75 75 50 0 60 100 M 1 J 75 0 50 8 60 0 80 60 (terminated) 8. 00 000 88z N D 090 50 FO 176 Part One Formulation of the Sales Program universities was common. This generally resulted in 10 to 15 new sales reps a year. Open newspaper advertise- ments usually produced 10 hires per year. The use of six local employment agencies, with fees of approxi- mately $2,000 per hired individual, resulted in 15 to 20 new reps per year. Last, any employee recommending a friend or an acquaintance who was subsequently hired received a $200 finder's fee. This practice typi- cally cost the company $2,000 per year. Wehner claims not to recruit personnel from competitors or customers. Wehner said he thought those hired through employ- ment agencies were the most successful, but he was not positive. The hiring process generally followed a similar pat- tern. The selected applicant completes a simple appli- cation form and is then interviewed by Wehner or his assistant for approximately 30 minutes. During that time, if the candidate seems motivated and enthusias- tic, and asks for the sales job, the applicant is asked back for additional interviews. The candidate then interviews with the distributor- ship's top manager for no more than 10 minutes. The San Francisco distributor is owned by Valley, and the new sales rep works for the distributor. Valley can reas- sign the sales rep to wholly owned distributors. All sales reps interact with the area distributor and often participate in training programs with the distributor's other two sales groups. Waller learned the distributor's top manager regards youth and physical characteristics as the most important traits an applicant should have to pass this stage. The next step involves an interview with Waller's predecessor, John Ruppert, who was promoted to a home office assignment as a major account manager. The recruit is then whisked off to spend a day in the field with an experienced sales rep. Waller questioned whether this day in the field, during which the recruit is "wined and dined" is an accurate representation of the job. If all of these hurdles are passed, the applicant is then offered the job. Pat Waller's work with the sales reps provided use- ful information. Waller traveled with two sales reps and discovered many new things about the sales job. Before being promoted to the sales manager position for the San Francisco division, Waller had moved through the ranks, starting as a sales rep in the Seattle division. As a sales rep, Waller served primarily in a missionary capacity, calling on liquor stores and taverns. Waller then advanced to district manager for the Seattle division. Next, Waller moved to the Phoenix division, where he served as area manager before accepting a home office assignment as a product manager assistant. This itinerary was typical for a person selected to move into sales management, except that most sales man- agers are promoted from the chain store sales force. Waller's new assignment represented his first exposure to major account management. On September 8, 2001, Waller traveled with Marv Flanigan, a nine-month veteran. Although scheduled to meet at 7 A.M., Marv was late, stating his hour-long drive was delayed by a terrible accident. Flanigan said the latest territory change created a longer commute for him. Since he was late, they started to work imme- diately, forgoing the customary cup of coffee Waller intended to buy as a warm-up tactic to learn about Flanigan's plans for the day. Waller and Flanigan spent nearly the entire morning at an Alpha Beta store (#561) building a 50-case display for Valley wines, resetting the cold box, and servicing the shelves. After a 15- minute presentation to the wine clerk, Flanigan and Waller left for the next call. When Waller congratulated Flanigan on the 50-case display, Flanigan quipped, "Thanks, but unfortunately it's not enough to make quota. Nobody, but nobody, ever makes quota. That's 25 cases short, and that store is one of my best accounts. And did you see my Santo Rey quota-90 cases no way!" During their afternoon together, Waller observed a very aggressive sales promotion that Flanigan pre- sented to a wine clerk at a Safeway store (#724). After- ward, Waller questioned the tenuous sales figures Flanigan quoted to the wine buyer. He responded by claiming. "John [division's previous sales manager] and Rick [Marv's current area manager] told me to stretch the sales estimates." Continuing, he revealed, "They said it's the only way to make my numbers. Rick even told me to pump up the numbers on the recap 1 send to Napa." Pumping up the numbers meant a sales rep would claim a 50-case display had been installed when the store manager or wine clerk would only order a 25- to 30-case display. The display would only look like a 50- case display: center boxes in the display would be empty. On September 23, 2001, Waller worked with Bill Murphy, Murphy, a six-month veteran, arrived grum- bling. He said his district manager called him at 10:30 the night before complaining about the condition of Safeway #507. After 30 minutes of specific instructions and other messages, Murphy had agreed to visit the store early that morning to correct the deficiencies. He mentioned that he received calls at night from his dis- trict manager about two to three times a week, often to check his progress on winery directives. These usually occurred, he claimed, during the hour or two he spent on preparation each night. During lunch, Murphy discussed his desire to move into management. He said, "Although district managers are often considered to be no more than baby sitters Case 1.1 The Valley Winery 177 for the new reps, I really think that I can do a great job. The pay doesn't even bother me. [District managers received $3,000 to $4,000 more.] I mean, with all the cases I've sold, if I were paid on commission, I'd already be rich. I think I can really train those new reps just as the manual says." good sense of the situation. At this point, Waller thought he was starting to get a Guidelines for a Good Case Analysis 1. Be complete. 2. Avoid rehashing case facts. 3. Make reasonable assumptions. 4. Don't confuse symptoms with problems. 5.Don't confuse opportunities with taking action. Deal with objectives realistically. 7. Recognize alternatives. x. Discuss the pros and cons of each alternative. 9. Make effective use of financial and other quantitative information. 10. Reach a clear decision. Outline for case analysis and Structure of the case Your analysis will be about of 4 pages long. 12 points, typed. double spaced, with a one inch margin all around A case analysis should have four basic areas: (1) Situation analysis (2) Defining symptoms, problems and opportunities (3) Objectives (4) Generating and evaluating alternatives (5) The final decision, i.e. your recommendation. Most cases do not provide complete information, and you have the liberty of making "reasonable and realistic assumptions" about the case. Do not pull things out of thin air, which have no foundation in the case. 1. Situation Analysis (approximately 1 pages) This section should contain the summary of the case. Important elements that should be considered while writing this section are: a. the nature of demand - i.e., who are the consumers and why do they buy. b. the extent of demand - i.e., the sales volume in units and dollars. C. the nature of competition - i.e., names and profiles of competitors. d. the environmental climate - i.e., what external factors affect the business. e. the stage of the PLC-i.e., introduction, maturity, growth, decline. f. the distribution structure - i.e., how is the product/service distributed to consumers. the strengths and weaknesses of the firm - i.e., what is the firm good/bad at. h. the cost structure of the firm - i.e., how are the costs incurred. 2. Identifying Symptoms, Problems and Opportunities (approximately page long) Try to distinguish between symptoms and problems. Based on the symptoms, find out whether there are key problems in the case or whether there are opportunities that can be exploited. 3. Objective(s) (approximately page long) Based on problems and opportunities, what objective(s) should the company have? 4. Generating and evaluating alternative marketing programs (approximately 1 /2 pages long) Based on the above objective(s), suggest 4 alternatives to achieve the objective. An objective(s) can be achieved through different marketing methods. List four alternatives, and evaluate each of them, with their pros and cons. 5. The decision (approximately page long) This section should contain your decision (recommendation) that you have arrived at, depending on how you have evaluated your different alternatives. You may pick one of the above alternatives, or combine two alternatives (don't combine all) to form your decision. However, you will have to justify why you eliminated other alternatives

rubric:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock