Question: Complete the steps below using cell references to given data or previous calculations. In some cases, a simple cell reference is all you need. To

Complete the steps below using cell references to given data or previous calculations. In some cases, a simple

cell reference is all you need. To copypaste a formula across a row or down a column, an absolute cell

reference or a mixed cell reference may be preferred. If a specific Ercel function is to be used, the directions

will specify the use of that function. Do not type in numerical data into a cell or function. Instead, make a

reference to the cell in which the data is found. Make your computations only in the blue cells highlighted

below. In all cases, unless otherwise directed, use the earliest appearance of the data in your formulas,

usually the Giren Data section.

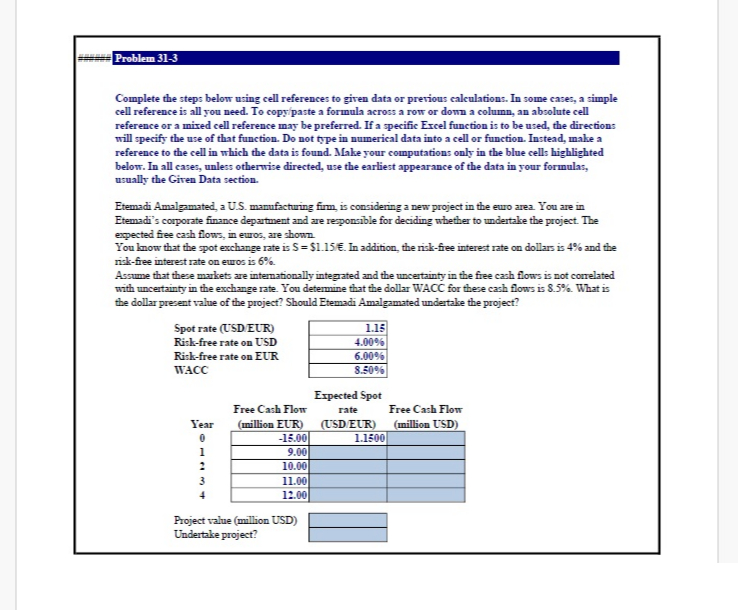

Etemadi Amalgamated, a US manufacturing firm, is considering a new project in the euro area. You are in

Etemadi's corporate finance department and are responsible for deciding whether to undertake the project. The

expected free cash flows, in euros, are shown.

You know that the spot exchange rate is $ f In addition, the riskfiee interest rate on dollars is and the

riskfree interest rate on euros is

Assume that these markets are internationally integrated and the uncertainty in the free cash flows is not conrelated

with uncertainty in the exchange rate. You determine that the dollar WACC for these cash flows is What is

the dollar present value of the project? Should Etemadi Amalgamated undertake the project?

Project value million USD

Undertake project? Requirements

Start Excel completed.

First, calculate the expected spot rate for the next few years by using the formula:

In cell by using cell references, calculate the expected spot rate for year pt Copy cell and

paste it onto cells E:E pt

In cell by using cell references, calculate the free cash flow in USD for year pt Copy cell

and paste it onto cells F:F pt

In cell by using cell references and the function NPV calculate the project value pt

In cell E select from the dropdown whether Etemadi Amalgamated should undertake the project pt

Save the workbook. Close the workbook and then exit Excel. Submit the workbook as directed.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock