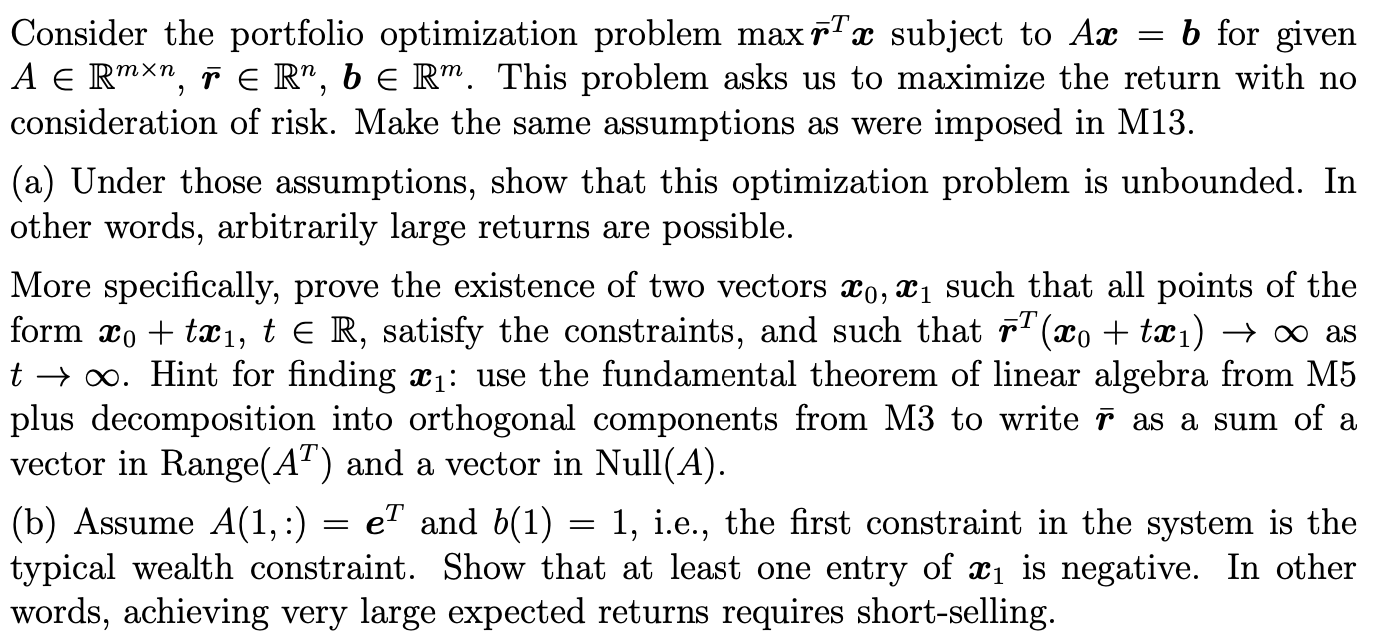

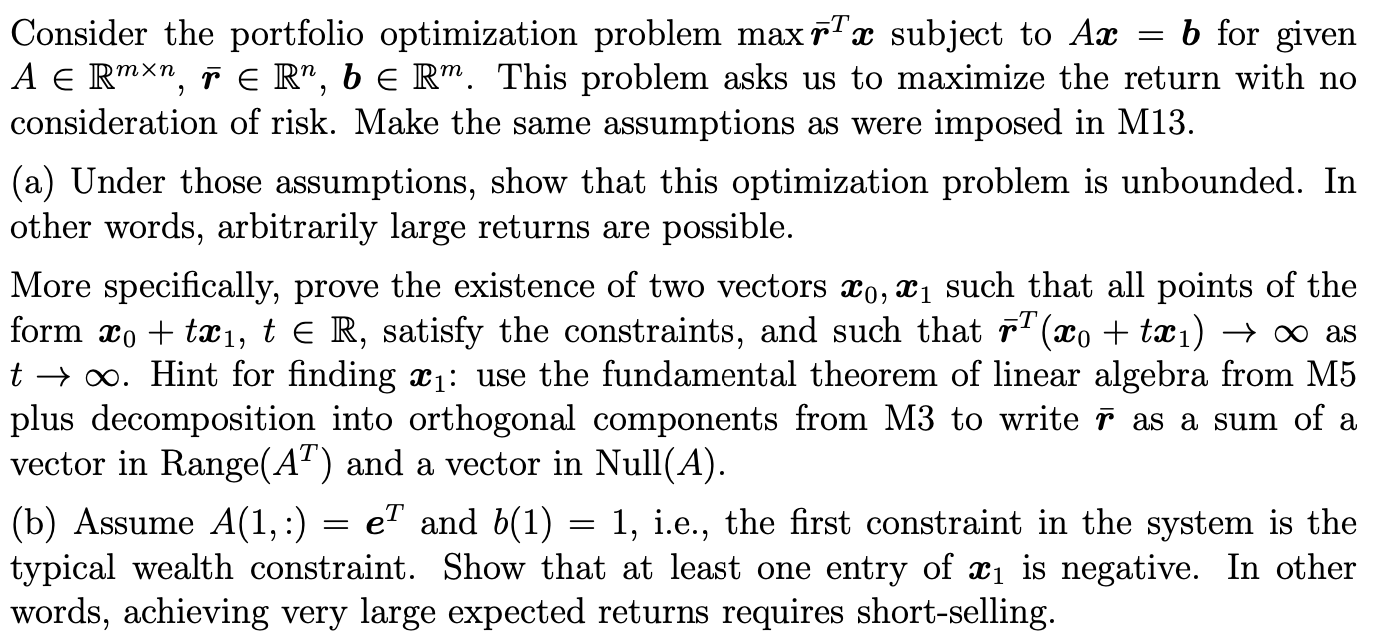

Question: = Consider the portfolio optimization problem max I x subject to Ax b for given A E RMXn, ER, b ER. This problem asks us

= Consider the portfolio optimization problem max I x subject to Ax b for given A E RMXn, ER", b ER". This problem asks us to maximize the return with no consideration of risk. Make the same assumptions as were imposed in M13. (a) Under those assumptions, show that this optimization problem is unbounded. In other words, arbitrarily large returns are possible. More specifically, prove the existence of two vectors Xo, X such that all points of the form xo + t21, t ER, satisfy the constraints, and such that pm (2Co + t) as t +0. Hint for finding X1: use the fundamental theorem of linear algebra from M5 plus decomposition into orthogonal components from M3 to write as a sum of a vector in Range(AT) and a vector in Null(A). (b) Assume A(1,:) et and b(1) = 1, i.e., the first constraint in the system is the typical wealth constraint. Show that at least one entry of Xi is negative. In other words, achieving very large expected returns requires short-selling. = = Consider the portfolio optimization problem max I x subject to Ax b for given A E RMXn, ER", b ER". This problem asks us to maximize the return with no consideration of risk. Make the same assumptions as were imposed in M13. (a) Under those assumptions, show that this optimization problem is unbounded. In other words, arbitrarily large returns are possible. More specifically, prove the existence of two vectors Xo, X such that all points of the form xo + t21, t ER, satisfy the constraints, and such that pm (2Co + t) as t +0. Hint for finding X1: use the fundamental theorem of linear algebra from M5 plus decomposition into orthogonal components from M3 to write as a sum of a vector in Range(AT) and a vector in Null(A). (b) Assume A(1,:) et and b(1) = 1, i.e., the first constraint in the system is the typical wealth constraint. Show that at least one entry of Xi is negative. In other words, achieving very large expected returns requires short-selling. =