Question: Consider two corporate bonds, call them A and B. Each of these bonds has the face value of $1,000, the remaining term-to-maturity = 12 years

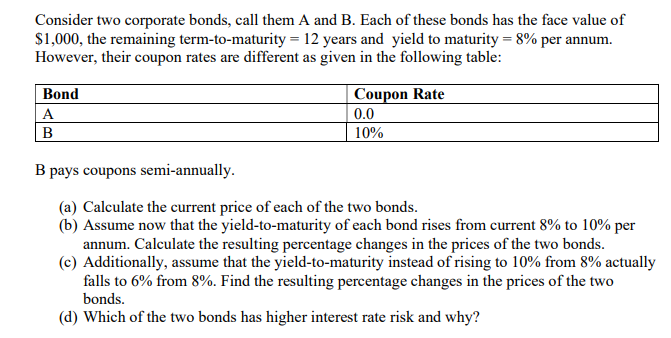

Consider two corporate bonds, call them A and B. Each of these bonds has the face value of $1,000, the remaining term-to-maturity = 12 years and yield to maturity = 8% per annum. However, their coupon rates are different as given in the following table: Bond A . Coupon Rate 0.0 10% B pays coupons semi-annually. (a) Calculate the current price of each of the two bonds. 6) Assume now that the yield-to-maturity of each bond rises from current 8% to 10% per annum. Calculate the resulting percentage changes in the prices of the two bonds. (c) Additionally, assume that the yield-to-maturity instead of rising to 10% from 8% actually falls to 6% from 8%. Find the resulting percentage changes in the prices of the two bonds. (d) Which of the two bonds has higher interest rate risk and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts