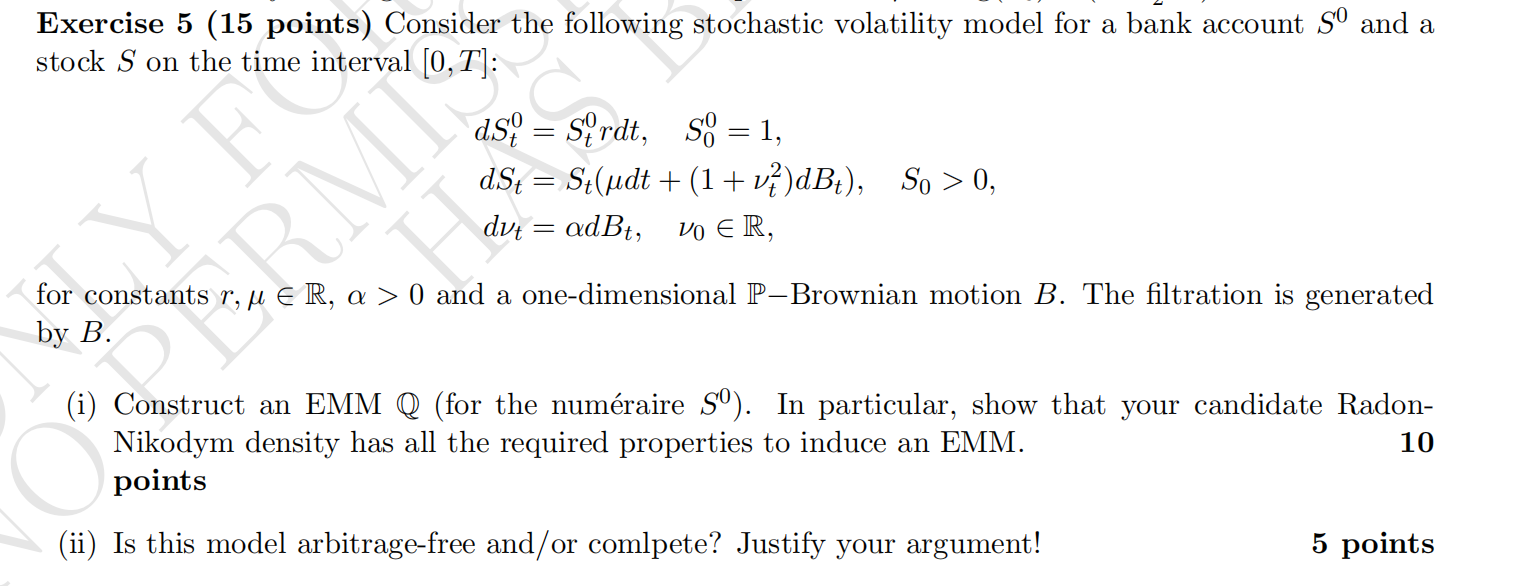

Question: Exercise 5 (15 points) Consider the following stochastic volatility model for a bank account S and a stock S on the time interval [0,T]:

Exercise 5 (15 points) Consider the following stochastic volatility model for a bank account S and a stock S on the time interval [0,T]: Y F by B. INY ds= Srdt, S = 1, dS = St(dt + (1+v) dB), So > 0, dvt = adBt, VO R, for constants r, R, > 0 and a one-dimensional P-Brownian motion B. The filtration is generated (i) Construct an EMM Q (for the numraire S). In particular, show that your candidate Radon- Nikodym density has all the required properties to induce an EMM. points (ii) Is this model arbitrage-free and/or compete? Justify your argument! 10 5 points

Step by Step Solution

There are 3 Steps involved in it

Exercise 5 Stochastic Volatility Model Analysis i Constructing an EMMQ for the Numraire S We can construct an Equivalent Martingale Measure EMM for th... View full answer

Get step-by-step solutions from verified subject matter experts